Author Archives: Richard Emmons

Author Archives: Richard Emmons

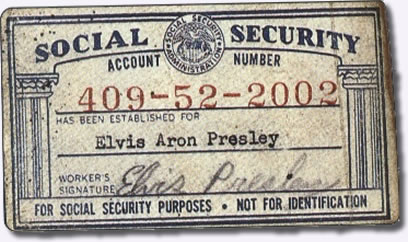

Social Security is back in the news these days. And the news isn’t pretty. We’ve seen a steep and prolonged drop in employment during this recession. Now social security tax revenues have now fallen below the benefits being paid out to current retirees. This hasn’t happened in 25 years so Congress needs to “do something” and you may get asked your opinion on this. Maybe in your office and maybe on your live radio show.

Social Security is back in the news these days. And the news isn’t pretty. We’ve seen a steep and prolonged drop in employment during this recession. Now social security tax revenues have now fallen below the benefits being paid out to current retirees. This hasn’t happened in 25 years so Congress needs to “do something” and you may get asked your opinion on this. Maybe in your office and maybe on your live radio show.

Financial advisors need to walk a fine line here. You have clients born before 1946 when the baby boomers first came on the scene. You have baby boomer clients who have retired after paying into Social Security their entire working careers. Other Baby Boomers have paid into Social Security for decades who won’t receive full benefits until age 67. You may have a growing number of Gen X/Y clients who will pay the most into Social Security and get the fewest benefits.

A couple recent articles underscored the coming generational battle over funding Social Security and who gets what benefits. One article on CNBC.com placed the blame squarely on the shoulders of the Baby Boomers:

Will Baby Boomers Bankrupt Social Security?

As the record federal budget deficit draws increasing scrutiny from Washington to Wall Street to Main Street, deficit hawks may take aim at entitlement programs including Social Security.

And, the nearly 80 million Baby Boomers phasing into retirement will set in motion a dynamic that—if not addressed by Congress—could result in the next generation getting fewer benefits.

After some soothing words about the strength of the ‘trust fund”, the article describes the affect of the Baby Boom generation:

Looking back, the outlook was rosy for most Americans in 1946, the year earmarked as the beginning of the so-called “baby boom.” With World War II finally over, a 15-year stretch of bad times that had begun with the great Depression was finally over. They responded by having more babies than ever before, more than 78 million of them by 1964.

For Social Security, the mini-population explosion was both beneficial and problematic. Social Security is funded mostly through payroll taxes, with present-day workers funding the payouts for retirees. Since there have been so many Boomers in the workforce for so many years, there were a lot more people putting money into the system than taking it out.

As Boomers begin to retire, the huge group of people putting money into the system will begin taking it out of the system, which then will be funded by a generation of workers—the so-called Gen X—whose numbers are some 15 million fewer. The surplus of money paid into the system by Boomers will allow it to run into the late 2030s, even though it will begin paying out more than it takes in by 2017.

Before I show how the 2017 forecast won’t happen, let’s listen to a Gen X’r to get a taste of the coming divide:

Count Gen-Xer Tom Firey among those younger workers who think they’re getting the short end of the stick. The managing editor of the conservative Cato Institute magazine, Regulation, first wrote about the subject nearly 10 years ago in a column headlined, “Boomers Fleece Generation X with Social Security.”

“Ever since we Gen-X/Yers began working, we’ve paid 12.4 percent of our earnings to Social Security,” he wrote. “In contrast, the Boomers will get a bargain. When they entered the workforce in the late 1960s, they paid only 6.5 percent of their earnings to Social Security. Only from 1990 on, when the Boomers had earned paychecks for a quarter-century, did they start paying 12.4 percent to Social Security, the same percentage we Gen-X/Yers have paid our whole lives.”

That’s why Firey dubbed it The Boomers’ Bargain: “They’ve paid less of their earnings into Social Security than we Gen-X/Yers, yet they’ll receive more in benefits than we will and we’ll pick up the tab.”

As often comes with age, Firey has mellowed some in the past 10 years, even injecting dark humor into his outlook today. He says, “The last two generations gave themselves some additional retirement benefits just before they left the workforce. The World War II generation gave itself annual COLA (cost-of-living allowance) raises in 1975, and the boomers gave themselves the prescription drug benefit earlier this decade.”

“In essence, these generations said, ‘I’m not willing to pay for these new benefits for myself, but I’m happy to force my kids and grandkids to pay for these benefits for me,’ “Firey added.

You can read the rest to learn about the Greenspan Commission of 1983. http://www.cnbc.com/id/34941334 Like President Carter’s fix in the late ’70’s, the Greenspan Commission’s recommendations of benefit cuts and tax hikes spared current retirees and supposedly fixed the problem for “30 years.”

You might be telling yourself, “What about the Trust Funds? Richard forgot about the trust funds!” My short answer is, “What trust? What funds? And what security?”

The reality of the situation is that the trust funds and $3 will buy you a cup of coffee at Starbucks. Now let’s look at the math and why Social Security needs a bailout.

Next in line for a bailout: Social Security

By Allan Sloan, senior editor at large, Fortune magazine

February 2, 2010

NEW YORK (Fortune) — Don’t look now. But even as the bank bailout is winding down, another huge bailout is starting, this time for the Social Security system.

A report from the Congressional Budget Office shows that for the first time in 25 years, Social Security is taking in less in taxes than it is spending on benefits.

Instead of helping to finance the rest of the government, as it has done for decades, our nation’s biggest social program needs help from the Treasury to keep benefit checks from bouncing — in other words, a taxpayer bailout.

No one has officially announced that Social Security will be cash-negative this year. But you can figure it out for yourself, as I did, by comparing two numbers in the recent federal budget update that the nonpartisan CBO issued last week.

The first number is $120 billion, the interest that Social Security will earn on its trust fund in fiscal 2010 (see page 74 of the CBO report). The second is $92 billion, the overall Social Security surplus for fiscal 2010 (see page 116).

This means that without the interest income, Social Security will be $28 billion in the hole this fiscal year, which ends Sept. 30.

Why disregard the interest? Because as people like me have said repeatedly over the years, the interest, which consists of Treasury IOUs that the Social Security trust fund gets on its holdings of government securities, doesn’t provide Social Security with any cash that it can use to pay its bills. The interest is merely an accounting entry with no economic significance.

The last sentence might have grabbed your attention. Surprised me to see it in a mainstream publication like Fortune magazine. Maybe it shouldn’t surprise us. How do you pay your business expenses, with cash or with accounts receivables? Of course, you can’t pay bills with IOU’s unless you first convert the IOU’s into cash. Same problem for the federal government except that Uncle Sam is already borrowing over a trillion dollars this year.

You can read the rest of the Fortune article here: http://money.cnn.com/2010/02/02/news/economy/social_security_bailout.fortune/index.htm

So how do you apply your marketing mindset to handle this situation? In your office, you deal with each person or couple based on their situation. Social Security is just one more (obviously major) factor to consider.

What if you’re asked this question on your radio show? Well, you need to be careful so you don’t needlessly inflame your listeners. Here are some possibilities:

My mother taught me long ago, “If you don’t have something nice to say, don’t say anything.” Kind of tough in this situation. How about, “Social Security has been a nice deal for the past 77 years and who knows what the future will bring?”

Without faith, people won’t take action. This includes taking risks and making long-term investments.

Without faith, people won’t take action. This includes taking risks and making long-term investments.

Some of my advisor clients moved clients’ money out of the stock market and into variable annuities before the crash of 2008. At least clients who would listen. Others maintained their faith in the stock market and paid the price. Now many investors wonder if they should trust Wall Street at all. So financial advisors need to adjust their messages to overcome this skepticism.

In this article in The Wall Street Journal, Jason Zweig surveys the financial battlefield and offers suggestions to financial advisors on how to regain trust.

Will We Ever Again Trust Wall Street?

For many investors, the market’s turbulence hasn’t just destroyed wealth. It has shattered their faith in the financial system itself.

Consider Philip Eberlin, 56 years old, who runs a woodwork-restoration business in Chicago Heights, Ill. Trading hot stocks a decade ago, Mr. Eberlin got burned on picks like Krispy Kreme and Tyco. In 2007 he got back into stocks, only to take another hit.

“Having been burned twice in 10 years,” says Mr. Eberlin, he now has about 80% of his family’s assets “protected from the market” in certificates of deposit and fixed annuities. “I don’t have trust in Wall Street to help the small investor in any way, shape or form.”

Mr. Eberlin isn’t alone. Late last year, Decision Research of Eugene, Ore., asked Americans how much they trusted bankers and other Wall Street leaders “to reduce the risk of the financial challenges the country is facing now.” On a scale of 1 to 5, with 1 meaning no trust at all, the rating averaged a paltry 1.7.

With such a loss of faith, how will companies be able to obtain the capital they need to expand? The foundations of the financial markets ultimately rest upon the confidence of mom-and-pop investors across the country.

But every investor has a fundamental need to believe that the world is just—that good people are ultimately rewarded, that bad people are eventually punished and that the system isn’t rigged to favor an undeserving few.

This belief in a just world is partly delusional; most of us realize that nice guys often finish last. But this delusion makes short-term setbacks endurable. “A belief that the world is fair and predictable is necessary in order for people to delay gratification and to make investments that will pay off in the long run,” says James Olson, a psychologist at the University of Western Ontario.

So when bad things happen, “people often prefer to blame themselves rather than believe they live in a chaotic and unjust world,” says Dale Miller, a psychology professor at Stanford University.After tech stocks crashed in 2000-2001, for instance, many investors kicked themselves for taking foolish risks.

This time around, however, many investors who followed the best advice were punished the worst. Someone who held a total-stock-market index fund lost more than 58% from October 2007 through March 2009 and remains 31% behind even after last year’s recovery.

These people can’t blame themselves; they did as they had been told. Meanwhile, they watched Wall Street firms parcel out billions in bonuses.

I believe the old truths remain valid: Buying and holding a diversified stock portfolio still makes sense. Paradoxically, as fewer people cling to their faith in traditional stock investing, the future rewards from it are likely to grow greater.

But that can take time. In 1952, two full decades after the Great Crash hit bottom, only 19% of wealthy Americans regarded stocks as the wisest investment choice, according to a Federal Reserve survey. Most investors thus sat out the great bull market of the 1950s, when stocks gained 19.4% annually.

How can faith be restored?

Wall Street firms need to be forthright in admitting their shortcomings. The more they protest their innocence, the more they make the typical investor feel that the financial world is unjust.

The Pecora hearings, held in the U.S. Senate in the 1930s, served partly as a form of public expiation, in which Wall Street’s leaders apologized for their firms’ conduct. The Financial Crisis Inquiry Commission, formed by Congress in 2009 and now holding its own hearings, may help investors feel that Wall Street can own up to its mistakes.

Finally, financial advisers need to be much less dogmatic and confident in their predictions. By admitting the extent of their own ignorance today, they would help prevent investors from feeling railroaded tomorrow.

The great thing about email these days is that it’s fast, easy and free. Yet take a look at your own in-box. Do you see lots of non-urgent messages you want to read when you get more time. Will you end up reading them? Or will you just delete them before you leave on your next vacation?

In this day of email overload, a printed client newsletter can help you stand out from your competitors and get noticed by your clients and prospects.

Watch this short video and learn the advantages of sending using a snail mail newsletter to stay in touch with your clients and prospects.

httpv://www.youtube.com/watch?v=a_HoZ3_7aok

Whenever I need to improve a sales letter, yellow page ad, magazine ad, or web page, I first zero in on something simple. Does the ad speak about the advisor or firm? Or does it speak about what’s in it for the client? What’s the ratio of “I” or “mine” versus “You” or “yours”?

Let me ask you a question: Do you read this website to learn about me or learn how to grow your financial planning practice with better marketing?

My mom might read this site to learn something new about me. Maybe. The rest of you read this because you want more clients, you want more assets under management, and you want to reduce the hassles of running a financial planning practice so you can enjoy your life more?

Seems so simple but 99% of ads out there don’t get this.

I first learned this concept from Jay Abraham in 1989. He taught me everyone is tuned into the same radio station: WII-FM. Remember WII-FM in your marketing and you’ll find success.

What does WII-FM stand for? “What’s In It For Me?”

That’s what you care about when you read these articles or get my living trust seminar product or hire me to redesign your website.

Your clients, and especially your prospecs, don’t care about your problems. They really only care about their problems:

Let me show you a political example of when this I/You concept is lost. It features President Obama. His campaign for president was a marketing tour-de-force. Master Clayton Makepeace called his budget proposal “The best sales copy ever on the worst product ever.” So he has staff who know their marketing. It seems that they took the day off a few days ago when the President gave this speech. Here is a 2 minute clip to make my point:

http://www.youtube.com/watch?v=I9UIpW_3P5s

You need to avoid the “I/my” approach in your marketing or your prospects will avoid you.

In a recent post, I warned advisors to be ready with answers to difficult questions. Here’s another one.

“If I follow your investment advice, will my retirement income keep up with inflation?”

In the past year, the Federal Reserve Bank has doubled the money supply. Will this cause higher retail prices? Imagine playing a game of Monopoly and starting the game with $3000 instead of the $1500 called out in the rules since the 1930’s. If you had twice the money, wouldn’t that make it easier to bid on Boardwalk and Park Place? Prices would rise because you’d have more money to spend.

When the Federal Reserve Bank pumps up the money supply, it causes prices to rise and bubbles to form. Bursting bubbles hurt owners of bubble-inflated assets such as tech stocks, mortgage backed securities, and real estate. Rising prices hurts families and especially hurts retirees.

Watch this short video to see how rising prices would affect a 92 year old who retired in 1973 at age 55.

Your clients want decent returns and to avoid losses. So where do you put their money? What’s hot one year may be cold as ice the next year. Hence the caveat that “past performance is no guarantee of future results.” Yet when investing for the long-term, it can pay to listen to those who made correct long-term calls in the past. Today’s guest columnist Bill Bonner made a dead-on long-term call 10 years ago…and he just made another for our new decade.

The Last Shall Be First

By Bill Bonner

01/22/10 Paris, France – The yen is falling. It’s down 5% against the dollar since November. Investors are finally noticing. With a deficit of 50% of GDP, the Japanese government walks where angels fear to tread. Americans aren’t far behind. To make a long story short, our money is on the angels.

Only an economist would dare to look 10 years ahead. Only a fool would put money on it. Today, we do both. But our new “Trade of the Decade,” is not so much a look into the future as it is a look at the past.

Ten years ago, your humble correspondent offered his first ‘Trade of the Decade.’ He should have stopped there, for the trade was a big success. It was a simpleton’s trade: Sell US stocks/buy gold. That was in the year 2000. At that time, US stocks had been going up for the previous 18 years, multiplying investors’ money 11 times. By then, stocks had been going up for so long that the memory of man ranneth not to the contrary. Investors’ imaginations saw no alternative. Stocks for the Long Run was the title of a popular book. It was also an investment formula that seemed unbeatable.

Alas, the formula proved beatable. It was time for stocks to go the other way. The first decade of the 21st century proved to be the worst time to hold stocks since the ’30s. Net returns were negative – especially when adjusted for inflation. Adjusted to the CPI, the Dow ended the decade down 40%.

The other side of the trade – the buy side – was just as simpleminded. Gold hit a high over $800 in 1980. Then, it slipped for the next 20 years. It didn’t come to rest until September 1999 at $260. That was the famous “Brown Bottom” in the yellow metal…when the then chancellor of the exchequer, Gordon Brown, sold Britain’s gold at the lowest price in two decades. (To bring readers up to date, now Mr. Brown applies his vision and energy to Britain’s economic recovery efforts.)

Gold is real money. But in the years when gold was being beaten down, other forms of money were running wild. Financial assets mushroomed all over the globe. A whole new ‘shadow banking’ system emerged…with new financial instruments, representing trillions…no, hundreds of trillions…of dollars. Prices on everything were soaring – equity, debt, real property. It did not take a genius to see that gold would have to catch up, sooner or later. As it turned out, no major asset class did better. Gold finished every single year higher than the year before. It doubled. Then, it doubled again.

What made the trade a success was neither clairvoyance nor omniscience; it was merely an observation known as ‘regression to the mean.’ The word ‘normal’ has been in the dictionary for a long time. It must be there for a reason. What it describes is where things tend to go when they’ve gotten out of whack. Regression to the mean is so powerful, no one escapes it. For every decade of walking around time, a person spends a million years dead. Over a century, practically every human regresses to the grave. So, what is so abnormal now that regression to the mean is as certain as death?

Almost all investments are expensive by most historical measures. But if all go down, what will they go down against? Money! That’s why real money – gold – is likely to go up again in the next 10 years. But gold is not cheap. It rose nearly 400% over the last 10 years and now is fairly priced. Gold in the treasure trove found in England last year is worth today about the same thing it was when it was buried 12 centuries ago. It cannot regress to the mean; it is already there.

On the buy side, we are looking for an investment that is despised…not one that is admired. And so, back to Japan, where equities peaked out in 1990 and have been going down ever since. While the Japanese government wanders among the stars, the private sector has dropped back to the ground. Or beneath it. Tokyo-listed stocks have lost 75% of their value, wiping out an entire generation worth of growth. Many Japanese companies sell for less than the value of their current net assets.

And now, after twenty years, Japan’s private businesses are finally benefiting from the stimulus programs. The government will go broke, but by destroying its own credit, Japan cuts the value of the yen and boosts profits for its exporters. Toyota’s local labor costs – in dollar terms – fell 5% in the last three months. And by the time the catastrophe is complete, Japan’s businesses could be the most competitive in the world. One way or another, 10 years from now, we’ll wager that Japanese stocks will be higher…if only relative to the rest of the world’s equities.

But of all the whack that investments might be out of, US Treasury debt stands above them all. For the last 27 years, the US government’s cost of borrowing has gone down. But while bond yields declined, the quantity of US debt exploded. Official, on-the-books debt trebled. Include off the books, unfunded financial obligations and the total reaches $118 trillion – 8 times GDP. And now the explosions come every month. As the depression continues, US deficit-financing needs could rise to $150 billion every 30 days. So far, the bond market has absorbed the shocks with good grace. But sometime in the next 10 years, the angels are bound to be proven right.

Sell US Treasury bonds. Buy Japanese stocks.

Regards,

Bill Bonner,

for The Daily Reckoning

Well, there you have it: Buy Japan and Sell Treasuries. We’ll all see how it all turns out in 2020.

For more insights on investments and the economy with a contrarian and witty twist, click through and subscribe to the Daily Reckoning e-zine.

Source: http://dailyreckoning.com/the-last-shall-be-first-2/

In this short video, Richard takes you into the “voting booth” and votes against 2 tax increases on the ballot in Oregon. What does this have to do with advisor marketing success?

Remember in most elections candidates and ballot measures win 51% to 49%. So whenever you take a public stand on a political matter you’ll likely to get half the voters mad. Your marketing mindset should tell you not to get your clients and prospective clients hopping mad with something you say!

As a financial advisor you’re used to asking your clients hard questions.

As a financial advisor you’re used to asking your clients hard questions.

Sometimes clients have ready answers. Other times a couple will look at each other and tell you, “We need to talk about this.” No problem, you don’t expect a ready answers for these tough questions.

But what about when your client or a prospective client asks YOU some tough questions? Are you ready with good answers?

In a recent issue, Fortune magazine named Apple CEO Steve Jobs, the “CEO of the Decade.” Steve Jobs is a master showman and watching his product intros is always a kick…even if you’re a hardcore Windows/Blackberry guy. This quote really jumped out at me:

A key Jobs business tool is his mastery of the message. He rehearses over and over every line he and others utter in public about Apple. ~ Fortune

For the curious, you can watch him in action below when he introduced the Macintosh (1984), iPod (2001) and iPhone (2007). He only had one chance to make a good first impression. So Steve practiced his lines over and over again and nailed the presentation.

Fortunately, you’ll likely be alone with your client in your office or conference room. A larger venue might be a living trust seminar with 25 or 30 people in the room. While a smaller stage than Steve Jobs commands, your ability to provide a sincere and convincing answer can win or lose the account.

What might you get asked? I dug around the Internet and found numerous lists of “questions to ask your financial advisor.” Here are some highlights:

5 Questions To Ask a Potential Financial Advisor

Any good financial advisor will have an area of expertise. You want someone who has expertise working with someone like you. If you’re about to retire, and they tell you they work with young families, maybe this isn’t the person for you. Find a financial advisor whose ideal client sounds very similar to your situation in terms of age, stage of life, and asset level.

What you are looking for here is, can you understand their explanation? If they speak over your head, or their answer makes no sense, then move on. You want to work with someone who can explain financial concepts to you in language you can understand.

Below are five concept oriented questions to consider asking:

Seven Questions to Ask When Picking a Financial Adviser (The Wall Street Journal)

As investors look for guidance in these troubled markets, one question looms above all others:

Whom can you trust?

During boom times, it was easy to hire a financial adviser and put your money on autopilot. Now the market is in chaos and thousands of investors have been devastated by fraud, with Madoffed threatening to become an all-too-common verb.

Small wonder that many investors are getting reluctant to put their faith in experts. More than three-quarters of individuals with at least $1 million to invest intend to move money away from their financial advisers, and more than half intend to leave their advisers altogether, according to Prince & Associates Inc., a market-research firm.

The trouble is, many investors don’t have the time or expertise to make all of their own investment decisions. So, having a professional on your side is crucial. But how can you guarantee that your expert is reliable?

Ask for a formal written outline of the services the adviser will be providing and what fees you will be paying. By setting concrete expectations, you can determine if an adviser is going to, say, “help you set goals and do budgeting or just make investment decisions,” says Ellen Turf, chief executive of the National Association of Personal Financial Advisors.

For instance, you can ask advisers to spell out what they think you are trying to achieve and what they think you should do to get there, including investment strategies, specific benchmarks and suggested financial products. If advisers can’t explain their plan in simple terms, another red flag should go up. Secret strategies like those touted by Mr. Madoff are no longer acceptable, Mr. Sonnenfeldt says.

Also ask advisers to spell out who else stands to gain from your relationship — such as affiliated broker-dealers and insurance agencies — as well as exactly how much the adviser, the adviser’s firm and all those other parties will earn from your business.

Finally, find out whether the advisers are going to take on fiduciary responsibility, in which they are legally bound to act in your best interest. If advisers don’t take this oath, they’re only required to sell you products that are deemed suitable for you — and those may not always be the best fit for your financial situation or objectives.

Eight Questions to Ask Your Financial Advisor

(1) Do you use a comprehensive approach to financial planning by directing our efforts around a written plan based upon my specific goals?

(2) How will you communicate, both initially and through time, what I am paying you, how I am paying you, and what I am receiving for it?

(3) Do you have any conflicts, limitations, or encumbrances that I need to be aware of, and will you communicate them in the future if any arise?

(4) What is your core philosophy regarding your work? What results would lead YOU to conclude that our work together is successful?

(5) Are you acting as a specialist or a generalist? In either case, who will be coordinating the specialists that will be needed over time to address my changing needs?

(6) How often do you meet with clients? What do those meetings look like, and what communication methods do you use between meetings?

(7) Will I be working directly with you, or through skilled assistants, and what procedures should I expect as far as phone calls made and received, mail sent and received, etc.?

(8) What issues, topics, or challenges should I NOT be concerned about, despite what I may hear through the media; what issues, topics, or challenges SHOULD I be concerned about, despite not hearing much about it; and, how will you help me do that?

How to Choose a Planner (CFP Board)

2 Q. What are your qualifications?

A. The term “financial planner” is used by many financial professionals. Ask the planner what qualifies him to offer financial planning advice and whether he is recognized as a CERTIFIED FINANCIAL PLANNER™ professional or CFP® practitioner, a Certified Public Accountant-Personal Financial Specialist (CPA-PFS), or a Chartered Financial Consultant (ChFC). Look for a planner who has proven experience in financial planning topics such as insurance, tax planning, investments, estate planning or retirement planning. Determine what steps the planner takes to stay current with changes and developments in the financial planning field. If the planner holds a financial planning designation or certification, check on his background with CFP Board or other relevant professional organizations. [Nice to see they included ChFC along with CFP.]

15 Questions to Ask a Financial Advisor [written by a CPA who is also a financial advisor]

3. Can the advisor explain their investment philosophy in simple language? A 10-year-old should be able to understand the logic of the investment philosophy.

5. Ask the advisor, “why are you in the business?” “Besides your alarm clock, what makes you get up in the morning?”

6. Can evidence be presented to back up the advisor’s investment approach?

7. Where is the advisors own money invested?

That last question might stump many advisors. Would you use a realtor to buy a house who has rented his whole life? Or buy stocks through a stockbroker who keeps all his money in money market funds? Would you keep your savings with a banker who keeps his savings under his mattress? Probably not.

So my advice to you is to click through a few of these articles and try to see things from your client’s perspective. You want to develop clear, convincing and sincere answers to these types of questions. Practice in front of a mirror. Ask your spouse to role play. Or use your webcam to record your answers and give them a critical view. You’ll be glad you did.

Now watch what careful preparation did for Steve Jobs. He made a great first impression. And followed through later on what he said. And prospered. Go and do likewise!

http://www.youtube.com/watch?v=G0FtgZNOD44

http://www.youtube.com/watch?v=gQ2CMMdowu0&feature=related

For financial advisors, now is the best of times and the worst of times. Out-of-control government spending, massive deficits, and dicey markets combine to make investing much more challenging for everyone. Including financial advisors. And individual investors who look for professional help. And retirees have seen their nest eggs shrink from ostrich size to turkey size. Or chicken size to sparrow size. With the stock market’s bounce back in 2009, a lot of lost ground has been made up. But will it last? Should investors stay in the market or go to cash?

For financial advisors, now is the best of times and the worst of times. Out-of-control government spending, massive deficits, and dicey markets combine to make investing much more challenging for everyone. Including financial advisors. And individual investors who look for professional help. And retirees have seen their nest eggs shrink from ostrich size to turkey size. Or chicken size to sparrow size. With the stock market’s bounce back in 2009, a lot of lost ground has been made up. But will it last? Should investors stay in the market or go to cash?

This screaming headline from The Telegraph got a lot of attention this week. This well-respected writer’s warning of hyperinflation in Japan has a lot of people thinking, “Could this really happen?” Ambrose Evans-Pritchard recommends staying in cash until the “real” recovery begins in mid to late 2010.

Give this a read and give it some thought. Your next client may walk in the door and ask, “Could this really happen?”

By Ambrose Evans-Pritchard, International Business Editor

Published: 6:15AM GMT 04 Jan 2010

The contraction of M3 money in the US and Europe over the last six months will slowly puncture economic recovery as 2010 unfolds, with the time-honoured lag of a year or so. Ben Bernanke will be caught off guard, just as he was in mid-2008 when the Fed drove straight through a red warning light with talk of imminent rate rises – the final error that triggered the implosion of Lehman, AIG, and the Western banking system.

As the great bear rally of 2009 runs into the greater Chinese Wall of excess global capacity, it will become clear that we are in the grip of a 21st Century Depression – more akin to Japan’s Lost Decade than the 1840s or 1930s, but nothing like the normal cycles of the post-War era. The surplus regions (China, Japan, Germania, Gulf) have not increased demand enough to compensate for belt-tightening in the deficit bloc (Anglo-sphere, Club Med, East Europe), and fiscal adrenalin is already fading in Europe. The vast East-West imbalances that caused the credit crisis are no better a year later, and perhaps worse. Household debt as a share of GDP sits near record levels in two-fifths of the world economy. Our long purge has barely begun. That is the elephant in the global tent.

We will be reminded too that the West’s fiscal blitz – while vital to halt a self-feeding crash last year – has merely shifted the debt burden onto sovereign shoulders, where it may do more harm in the end if handled with the sort of insouciance now on display in Britain.

Yields on AAA German, French, US, and Canadian bonds will slither back down for a while in a fresh deflation scare. Exit strategies will go back into the deep freeze. Far from ending QE, the Fed will step up bond purchases. Bernanke will get religion again and ram down 10-year Treasury yields, quietly targeting 2.5pc. The funds will try to play the liquidity game yet again, piling into crude, gold, and Russian equities, but this time returns will be meagre. They will learn to respect secular deflation.

Weak sovereigns will buckle. The shocker will be Japan, our Weimar-in-waiting. This is the year when Tokyo finds it can no longer borrow at 1pc from a captive bond market, and when it must foot the bill for all those fiscal packages that seemed such a good idea at the time. Every auction of JGBs will be a news event as the public debt punches above 225pc of GDP. Finance Minister Hirohisa Fujii will become as familiar as a rock star.

Once the dam breaks, debt service costs will tear the budget to pieces. The Bank of Japan will pull the emergency lever on QE. The country will flip from deflation to incipient hyperinflation. The yen will fall out of bed, outdoing China’s yuan in the beggar-thy-neighbour race to the bottom. By then China too will be in a quandary. Wild credit growth can mask the weakness of its mercantilist export model for a while, but only at the price of an asset bubble. Beijing must hit the brakes this year, or store up serious trouble. It will make as big a hash of this as Western central banks did in 2007-2008.

The European Central Bank will stick to its Wagnerian course, standing aloof as ugly loan books set off wave two of Europe’s banking woes. The Bundesbank will veto proper QE until it is too late, deeming it an implicit German bail-out for Club Med.

More hedge funds will join the EMU divergence play, betting that the North-South split has gone beyond the point of no return for a currency union. This will enrage the Eurogroup. Brussels will dust down its paper exploring the legal basis for capital controls. Italy’s Giulio Tremonti will suggest using EU terror legislation against “speculators”.

Wage cuts will prove a self-defeating policy for Club Med, trapping them in textbook debt-deflation. The victims will start to notice this. Articles will appear in the Greek, Spanish, and Portuguese press airing doubts about EMU. Eurosceptic professors will be ungagged. Heresy will spread into mainstream parties.

Greece’s Prime Minister Papandréou will balk at EMU immolation. The Hellenic Socialists will call Europe’s bluff, extracting loans that gain time but solve nothing. Berlin will climb down and pay, but only once: thereafter, Zum Teufel.

In the end, the Euro’s fate will be decided by strikes, street protest, and car bombs as the primacy of politics returns. I doubt that 2010 will see the denouement, but the mood music will be bad enough to knock the euro off its stilts.

The dollar rally will gather pace. America’s economy – though sick – will shine within the even sicker OECD club. The British will need the shock of a gilts crisis to shatter their complacency. In time, the Dunkirk spirit will rise again. Mervyn King’s pre-emptive QE and timely devaluation will bear fruit this year, sparing us the worst.

By mid to late 2010, we will have lanced the biggest boils of the global system. Only then, amid fear and investor revulsion, will we touch bottom. That will be the buying opportunity of our lives.

Do you normally see the glass as half empty or half full? I’ve always been a “half-full” kind of guy even when the glass is maybe 1/8 full. I just don’t see the 7/8 empty and just charge ahead undaunted!

It doesn’t take a Wall Street Analyst to see the past decade was a downer for most Americans. The joke about the 401k becoming a 201k is sad/funny just because it’s true for so many people. Of course, the joke should be modified a bit because with 2009 stock market bounce many people now have 301k’s!

Why is this an opportunity for independent financial advisors?

Because many folks tried a “do-it-yourself” approach to retirement planning and investments and came up short over the past 10 years. Their goal of retirement got pushed out so they know they need to do better and soon. Your task? Let them know independent, objective and well-informed advice can help them reach their financial goals.

So read this article from The Daily Reckoning knowing that plenty of folks in your city need your help to reach their financial goals. Your job is to attract their attention, let them know what makes you different and how that can help them, and then get to work helping them.

By Ian Mathias

01/04/10 Baltimore, Maryland – Before we dive into 2010, let’s close the books on the last 10 years — that decade of reckoning. We noted before Christmas that, as we forecast long ago, the major stock indexes were a bust for the decade. But check this out… Were the last 10 years a wash for the whole economy?

So what’s the term for 10 years of no growth in jobs, the slowest GDP growth in 70 years and a 4% fall in inflation-adjusted net worth? Dormancy? Depression? Whatever it is… ouch.

“Historically, downturns have been enormously creative times technologically,” notes Patrick Cox, our tech analyst. “Our current economic mess will be no exception. Economic pressures are forcing reassessments and hard, creative choices. The result will be an explosion of breakthrough technologies. Nobel laureate economist Gary Becker is just one of those studying business cycles who predicts that the recovery from our current mess will be unparalleled and spectacular…

“In the early 1400s, German goldsmith Johannes Gutenberg invented the movable-type printing press. This invention did far more than facilitate book production and increase the availability of knowledge. It started an information technology (IT) revolution that continues to accelerate even today.

“In Gutenberg’s era, his advances in lithography not only increased access to the world’s greatest thinkers. They also put practical business and technical knowledge in the hands of commoners. This seemingly insignificant invention smashed monopolies of thought and political power. The result was exponential growth in science, technology and democratic ideals. The Renaissance and the Enlightenment followed, on up to our present era.

“We’ve already seen a series of printed circuit lithography technologies revolutionize the electronics industry. Every electronic device you own — from your television to your mobile phone — contains a lithographically printed circuit board of one form or another. Like many of the transformational technologies of the last century, it was invented during the Great Depression. The timing was not a fluke.”