Washington Reforms Health Care And Taxes

Tax Attorney Ed Lyon comments on Sunday’s healthcare reform bill and how it could affect your tax bill and your clients’ tax bills.

Tax Attorney Ed Lyon comments on Sunday’s healthcare reform bill and how it could affect your tax bill and your clients’ tax bills.

Did you hear the reconciliation bill “adds a 3.8% ‘Unearned Income Medicare Contribution’ on investment income – specifically, interest, dividends, annuities, royalties, capital gains, and rents – for taxpayers with Adjusted Gross Income above $200,000 individuals and $250,000 families”? I wonder if AARP signed off on that little detail?

Washington Reforms Health Care And Taxes

Sunday’s night’s health care bill will go down as one of those once-in-a-generation accomplishments. I’m not here to debate the merits of the bill – historians will still be doing that decades from now. But it’s important to point out some important tax changes included in the bill and the companion “reconciliation” bill now before the Senate. (Just how important are they? Well, the Congressional Budget Office says the IRS will need $10 billion and 17,000 new employees to enforce its share of the new rules!)

Here are some of the key tax provisions:

- Starting immediately, certain small businesses with less than 10 employees will get a 35% credit for the cost of providing employee health benefits.

- Starting in 2011, employers will have to report the value of health benefits on Form W2.

- The penalty tax for Health Savings Account distributions not used for health care expenses doubles from 10% to 20%. This will discourage using HSAs for supplemental retirement savings.

- Starting in 2013, the 7.5% floor for deducting medical and dental expenses climbs to 10% (unless you or your spouse are 65 or older, in which case it remains at 7.5% until 2016).

- Healthcare flexible spending account contributions are capped at $2,500 per year.

- Starting in 2014, businesses with more than 50 employees will have to offer heath benefits or pay a penalty of $750/employee.

The reconciliation bill includes one more unwelcome surprise. Currently, the Medicare tax is limited to 2.9% of earned income. The reconciliation bill imposes an additional Medicare tax of 0.9% on earned income above $200,000 (individuals) or $250,000 (families). It also adds a 3.8% “Unearned Income Medicare Contribution” on investment income – specifically, interest, dividends, annuities, royalties, capital gains, and rents – for taxpayers with Adjusted Gross Income above those same thresholds. Those new levies would take effect in 2013.

The complete bill is 1,018 pages, so it’s going to take some time to analyze. But we’ll be paying close attention as details become available. In the meantime, call us with any questions!

Remember that the Reconciliation Bill still needs to pass the Senate. Democrat Senator Ben Nelson announced he will vote “No” because of the Medicare tax on unearned income. Let’s wait and see what happens. To learn more about Ed Lyon’s tax coaching solution go to www.taxcoachsoftware.com.

Investment Lessons from Warren Buffett

In a previous article, we looked at Warren Buffett’s Berkshire Hathaway’s annual shareholder letter and drew some marketing lessons for financial advisors. Now let’s look at the shareholder letter and draw some lessons on how to invest your client’s money.

In a previous article, we looked at Warren Buffett’s Berkshire Hathaway’s annual shareholder letter and drew some marketing lessons for financial advisors. Now let’s look at the shareholder letter and draw some lessons on how to invest your client’s money.

Now let’s review the letter again and get some investment insights from it. In the very first paragraph, he touts fabulous results for the past year:

Our gain in net worth during 2009 was $21.8 billion, which increased the per-share book value of both our Class A and Class B stock by 19.8%. Over the last 45 years (that is, since present management took over) book value has grown from $19 to $84,487, a rate of 20.3% compounded annually.*

I realize that past performance is no guarantee of future performance, but 20.3% for 45 years! Let’s be thankful Berkshire is a public company so we can watch what Warren Buffett does and learn from a master. The Wall Street Journal aptly summarized results and investment philosophy:

On Saturday, Mr. Buffett’s Berkshire Hathaway reported that net earnings rocketed 61% last year to $5,193 per share, while book value jumped 20% to a record high. Berkshire’s Class A shares, which slumped to nearly $70,000 last year, have rebounded to $120,000.

Those bets on GE and Goldman? They’ve made billions so far. And anyone who took Mr. Buffett’s advice and invested in the stock market in October 2008, even through a simple index fund, is up about 25%.

This is nothing new, of course. Anyone who held a $10,000 stake in Berkshire Hathaway at the start of 1965 has about $80 million today.

How does he do it? Mr. Buffett explained his beliefs to new investors in his letter to stockholders Saturday:

Stay liquid. “We will never become dependent on the kindness of strangers,” he wrote. “We will always arrange our affairs so that any requirements for cash we may conceivably have will be dwarfed by our own liquidity. Moreover, that liquidity will be constantly refreshed by a gusher of earnings from our many and diverse businesses.”

Buy when everyone else is selling. “We’ve put a lot of money to work during the chaos of the last two years. It’s been an ideal period for investors: A climate of fear is their best friend … Big opportunities come infrequently. When it’s raining gold, reach for a bucket, not a thimble.”

Don’t buy when everyone else is buying. “Those who invest only when commentators are upbeat end up paying a heavy price for meaningless reassurance,” Mr. Buffett wrote. The obvious corollary is to be patient. You can only buy when everyone else is selling if you have held your fire when everyone was buying.

Value, value, value. “In the end, what counts in investing is what you pay for a business-through the purchase of a small piece of it in the stock market-and what that business earns in the succeeding decade or two.”

Don’t get suckered by big growth stories. Mr. Buffett reminded investors that he and Berkshire Vice Chairman Charlie Munger “avoid businesses whose futures we can’t evaluate, no matter how exciting their products may be.”

Most investors who bet on the auto industry in 1910, planes in 1930 or TV makers in 1950 ended up losing their shirts, even though the products really did change the world. “Dramatic growth” doesn’t always lead to high profit margins and returns on capital. China, anyone?

Understand what you own. “Investors who buy and sell based upon media or analyst commentary are not for us,” Mr. Buffett wrote.

“We want partners who join us at Berkshire because they wish to make a long-term investment in a business they themselves understand and because it’s one that follows policies with which they concur.”

Defense beats offense. “Though we have lagged the S&P in some years that were positive for the market, we have consistently done better than the S&P in the eleven years during which it delivered negative results. In other words, our defense has been better than our offense, and that’s likely to continue.” All timely advice from Mr. Buffett for turbulent times.

A 2008 academic study of Berkshire over a 30-year period attempted to uncover the secret of Warren Buffett’s success. And recommended just imitating a winning investment strategy.

Imitation is the Sincerest Form of Flattery: Warren Buffett and Berkshire Hathaway

Gerald S. Martin, American University – Kogod School of BusinessJohn Puthenpurackal, University of Nevada, Las Vegas – Department of Finance

April 15, 2008

Abstract:

We analyze Berkshire Hathaway’s equity portfolio over the 1976 to 2006 period and explore potential explanations for its superior performance. Contrary to popular belief, we find Berkshire Hathaway invests primarily in large-cap growth rather than “value” stocks.

Over the period the portfolio beat the benchmarks in 27 out of 31 years, on average exceeding the S&P 500 Index by 11.14%, the value-weighted index of all stocks by 10.92%, and a Fama and French characteristic-based portfolio by 8.56% per year. Although beating the market in all but four years can statistically happen due to chance, incorporating the magnitude by which the portfolio beats the market makes a luck explanation extremely unlikely even after taking into account ex-post selection bias.

We find that Berkshire Hathaway’s portfolio is concentrated in relatively few stocks with the top five holdings averaging 73% of the portfolio value. While increased volatility is normally associated with higher concentration we show the volatility of the portfolio is driven by large positive returns and not downside risk. The market appears to under-react to the news of a Berkshire Hathaway stock investment since a hypothetical portfolio that mimics the investments at the beginning of the following month after they are publicly disclosed also earns significantly positive abnormal returns of 10.75% over the S&P 500 Index.

Our evidence suggests the Berkshire Hathaway triumvirates of Warren Buffett, Charles Munger, and Lou Simpson posses’ investment skill unlikely to be explained by Efficient Market Theory.

Source: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=806246&rec=1&srcabs=1005564

To be blunt about it, Warren Buffett demolished the Efficient Market Theory.

You can read the rest of the study if you like. Time is short so let’s look at the Wall Street Journal’s summary from a 3/1/2010 report:

It might not be practical to buy all of Buffett’s holdings. He owns 40 stocks and many of them are tiny positions. Here are two other approaches investors can take:

Slightly speculative: Buy the stocks Buffett is increasing his positions in. The idea is you can get in at prices similar to Buffett and it might be the stocks he feels most strongly about right now.

This past quarter:

Republic Services (RSG): Buffett increased his holdings by 129%

Iron Mountain (IRM): Increased by 108%

Beckton Dickinson (BDX): Increased by 25%

Walmart (WMT): Increased by 3.2%

Wells Fargo (WFC): Increased by 2.2%

The blog Market Folly summarizes the increases and decreases here.The “Buffett Aristocrats”: The S&P publishes a list of its dividend aristocrats – stocks that have increased their dividends for more than 25 years in a row. Buffett owns a basket of these, which I call the Buffett Aristocrats. These might be solid plays both for the income (since you can feel comfortable that they will probably increase, or at least keep, their dividends in the future) and capital appreciation (all of these companies have done well over time and, besides, Buffett likes them):

BDX – has increased its dividend for 37 years in a row. 1.9% dividend

KO – 47 years – 3.3% yield

LOW – 47 years – 1.5%

*PG – 53 years – 2.8%

WMT – 35 years – 2%

*XOM – 27 years – 2.6%

*JNJ – 47 years – 3.1%

* Buffett reduced his position this past quarter

Source: http://blogs.wsj.com/financial-adviser/2010/03/01/introducing-the-buffett-aristocrats/

Well there you have it. Go and do likewise!

White House Sets New Rules on Retirement Accounts

Ronald Reagan once said “the nine most terrifying words in the English language are, ‘I’m from the government and I’m here to help.’ Yesterday, Vice President Biden issued the “Middle Class Task Force Annual Report” which included planned rule changes aimed at ensuring workers receive objective investment advice for their 401(k)s and IRAs.

Ronald Reagan once said “the nine most terrifying words in the English language are, ‘I’m from the government and I’m here to help.’ Yesterday, Vice President Biden issued the “Middle Class Task Force Annual Report” which included planned rule changes aimed at ensuring workers receive objective investment advice for their 401(k)s and IRAs.

Will the new rules really help employees? Only time will tell. Let’s start with what the White House announcement:

Also at today’s event, the Vice President announced that the Department of Labor is proposing new protections for workers with 401(k)s and IRAs. These new protections are an important step in the Administration’s efforts to make the retirement system more secure for middle class workers and families. The regulations will protect workers from conflicts of interest and expand the opportunities for employers to offer workers the expert investment advice they need to make the best possible decisions about how to save their hard-earned wages.

“A secure retirement is essential to workers and the nation’s economy. Along with Social Security and personal savings, secure retirement allows Americans to remain in the middle class when their working days are done. And, the money in the retirement system brings tremendous pools of investment capital, creating jobs and expanding our economy,” said U.S. Deputy Secretary of Labor Seth Harris. “These rules will strengthen America’s private retirement system by ensuring workers get good, objective information. When that happens, workers make the kind of decisions that are good for their families and the nation as the whole.” Source: http://www.whitehouse.gov/the-press-office/vice-president-biden-issues-middle-class-task-force-annual-report

So how will this affect financial advisors? Here’s what the Financial Times had to say:

The new rules would require retirement investment advisers and money managers to either base their advice on computer models that have been certified as independent, or they would prohibit them from suggesting workers to invest in funds with which they are affiliated or from which they receive commissions. Source: http://www.ft.com/cms/s/0/d81ac69a-22f3-11df-a25f-00144feab49a.html?nclick_check=1

This sounds ominous because financial advisors will either need to use independently certified computer models or no longer suggest funds for which they receive commissions. Remember that the rules have been proposed and could change. And they don’t affect all investors. Yet.

The Department of Labor issued a related press release which partly clarifies who would be covered by these proposed rules:

The first of the two rules would ensure workers receive unbiased advice about how to invest in their individual retirement accounts or 401(k) plans. If the rule is adopted, it would put in place safeguards preventing investment advisors from slanting their advice for their own financial benefit. Investment advisors also would be required to disclose their fees, and computer models used to offer advice would have to be certified as objective and unbiased. The department estimates that 2 million workers and 13 million IRA holders would benefit from this rule to the tune of $6 billion.

The second rule announced today establishes new guidelines on the disclosure of funding and other financial information to workers participating in multiemployer retirement plans — those collectively bargained by unions and groups of employers. It will ensure transparency by guaranteeing workers can better monitor the financial condition and day-to-day operations of their retirement investments. The rule will go into effect in April 2010. Source: http://www.prnewswire.com/news-releases/us-labor-department-rules-to-improve-retirement-security-announced-as-part-of-white-house-middle-class-task-forces-year-end-report-85499197.html

These rules stem from the Obama Administration’s goal of helping the middle class. Many 401(k)s became 201(k)s and with the stock market bounce might be back to 301(k) level now. Will these rules help? Only time will tell. Are the proposed rules realistic? Let’s end with a quote from a Reuters story:

“Expert advice can be helpful, but that advice must be unbiased and there must be no risk that the adviser will benefit from steering workers to particular investments,” Deputy Labor Secretary Seth Harris said at the event. Source: http://www.reuters.com/article/idUSTRE61P26O20100226

You can watch the 29 minute White House announcement here. The part dealing with retirement account protection is the first 10 minutes.

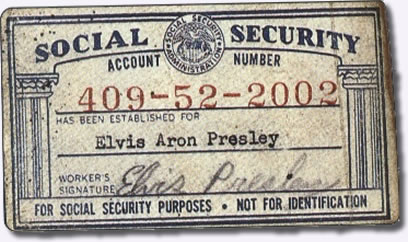

Advisor Marketing on the Latest Social Security Bailout

Social Security is back in the news these days. And the news isn’t pretty. We’ve seen a steep and prolonged drop in employment during this recession. Now social security tax revenues have now fallen below the benefits being paid out to current retirees. This hasn’t happened in 25 years so Congress needs to “do something” and you may get asked your opinion on this. Maybe in your office and maybe on your live radio show.

Social Security is back in the news these days. And the news isn’t pretty. We’ve seen a steep and prolonged drop in employment during this recession. Now social security tax revenues have now fallen below the benefits being paid out to current retirees. This hasn’t happened in 25 years so Congress needs to “do something” and you may get asked your opinion on this. Maybe in your office and maybe on your live radio show.

Financial advisors need to walk a fine line here. You have clients born before 1946 when the baby boomers first came on the scene. You have baby boomer clients who have retired after paying into Social Security their entire working careers. Other Baby Boomers have paid into Social Security for decades who won’t receive full benefits until age 67. You may have a growing number of Gen X/Y clients who will pay the most into Social Security and get the fewest benefits.

A couple recent articles underscored the coming generational battle over funding Social Security and who gets what benefits. One article on CNBC.com placed the blame squarely on the shoulders of the Baby Boomers:

Will Baby Boomers Bankrupt Social Security?

As the record federal budget deficit draws increasing scrutiny from Washington to Wall Street to Main Street, deficit hawks may take aim at entitlement programs including Social Security.

And, the nearly 80 million Baby Boomers phasing into retirement will set in motion a dynamic that—if not addressed by Congress—could result in the next generation getting fewer benefits.

After some soothing words about the strength of the ‘trust fund”, the article describes the affect of the Baby Boom generation:

Looking back, the outlook was rosy for most Americans in 1946, the year earmarked as the beginning of the so-called “baby boom.” With World War II finally over, a 15-year stretch of bad times that had begun with the great Depression was finally over. They responded by having more babies than ever before, more than 78 million of them by 1964.

For Social Security, the mini-population explosion was both beneficial and problematic. Social Security is funded mostly through payroll taxes, with present-day workers funding the payouts for retirees. Since there have been so many Boomers in the workforce for so many years, there were a lot more people putting money into the system than taking it out.

As Boomers begin to retire, the huge group of people putting money into the system will begin taking it out of the system, which then will be funded by a generation of workers—the so-called Gen X—whose numbers are some 15 million fewer. The surplus of money paid into the system by Boomers will allow it to run into the late 2030s, even though it will begin paying out more than it takes in by 2017.

Before I show how the 2017 forecast won’t happen, let’s listen to a Gen X’r to get a taste of the coming divide:

Count Gen-Xer Tom Firey among those younger workers who think they’re getting the short end of the stick. The managing editor of the conservative Cato Institute magazine, Regulation, first wrote about the subject nearly 10 years ago in a column headlined, “Boomers Fleece Generation X with Social Security.”

“Ever since we Gen-X/Yers began working, we’ve paid 12.4 percent of our earnings to Social Security,” he wrote. “In contrast, the Boomers will get a bargain. When they entered the workforce in the late 1960s, they paid only 6.5 percent of their earnings to Social Security. Only from 1990 on, when the Boomers had earned paychecks for a quarter-century, did they start paying 12.4 percent to Social Security, the same percentage we Gen-X/Yers have paid our whole lives.”

That’s why Firey dubbed it The Boomers’ Bargain: “They’ve paid less of their earnings into Social Security than we Gen-X/Yers, yet they’ll receive more in benefits than we will and we’ll pick up the tab.”

As often comes with age, Firey has mellowed some in the past 10 years, even injecting dark humor into his outlook today. He says, “The last two generations gave themselves some additional retirement benefits just before they left the workforce. The World War II generation gave itself annual COLA (cost-of-living allowance) raises in 1975, and the boomers gave themselves the prescription drug benefit earlier this decade.”

“In essence, these generations said, ‘I’m not willing to pay for these new benefits for myself, but I’m happy to force my kids and grandkids to pay for these benefits for me,’ “Firey added.

You can read the rest to learn about the Greenspan Commission of 1983. http://www.cnbc.com/id/34941334 Like President Carter’s fix in the late ’70’s, the Greenspan Commission’s recommendations of benefit cuts and tax hikes spared current retirees and supposedly fixed the problem for “30 years.”

You might be telling yourself, “What about the Trust Funds? Richard forgot about the trust funds!” My short answer is, “What trust? What funds? And what security?”

The reality of the situation is that the trust funds and $3 will buy you a cup of coffee at Starbucks. Now let’s look at the math and why Social Security needs a bailout.

Next in line for a bailout: Social Security

By Allan Sloan, senior editor at large, Fortune magazine

February 2, 2010

NEW YORK (Fortune) — Don’t look now. But even as the bank bailout is winding down, another huge bailout is starting, this time for the Social Security system.

A report from the Congressional Budget Office shows that for the first time in 25 years, Social Security is taking in less in taxes than it is spending on benefits.

Instead of helping to finance the rest of the government, as it has done for decades, our nation’s biggest social program needs help from the Treasury to keep benefit checks from bouncing — in other words, a taxpayer bailout.

No one has officially announced that Social Security will be cash-negative this year. But you can figure it out for yourself, as I did, by comparing two numbers in the recent federal budget update that the nonpartisan CBO issued last week.

The first number is $120 billion, the interest that Social Security will earn on its trust fund in fiscal 2010 (see page 74 of the CBO report). The second is $92 billion, the overall Social Security surplus for fiscal 2010 (see page 116).

This means that without the interest income, Social Security will be $28 billion in the hole this fiscal year, which ends Sept. 30.

Why disregard the interest? Because as people like me have said repeatedly over the years, the interest, which consists of Treasury IOUs that the Social Security trust fund gets on its holdings of government securities, doesn’t provide Social Security with any cash that it can use to pay its bills. The interest is merely an accounting entry with no economic significance.

The last sentence might have grabbed your attention. Surprised me to see it in a mainstream publication like Fortune magazine. Maybe it shouldn’t surprise us. How do you pay your business expenses, with cash or with accounts receivables? Of course, you can’t pay bills with IOU’s unless you first convert the IOU’s into cash. Same problem for the federal government except that Uncle Sam is already borrowing over a trillion dollars this year.

You can read the rest of the Fortune article here: http://money.cnn.com/2010/02/02/news/economy/social_security_bailout.fortune/index.htm

So how do you apply your marketing mindset to handle this situation? In your office, you deal with each person or couple based on their situation. Social Security is just one more (obviously major) factor to consider.

- All of your clients who are still in the work force should be reminded that Social Security was never intended to be the mainstay of a person’s retirement income. So they should be encouraged to work longer and save more and not retire until they have enough money invested to outlast their expected lifetimes.

- Gen X’rs can get your sympathy: A worker earning $95,000 per year who expects to retire in 2045 will pay in $200,000 more in Social Security taxes than he or she will receive in benefits. Ouch.

- For your retired clients, you can use annual reviews to compare their retirement nest egg against their life expectancy. Maybe they should go back to work. Or cut their expenses. Or sell their home, downsize and invest the difference.

What if you’re asked this question on your radio show? Well, you need to be careful so you don’t needlessly inflame your listeners. Here are some possibilities:

- You can blame Congress for spending the Social Security trust funds.

- You can blame Congress for not acting sooner (and reminding your listeners that Congress still needs to act on the federal estate tax situation).

- You can say that everyone’s situation is different so you can’t offer financial advice without more information (kinda wimpy but might result in a visit to your office)

- You can offer general advice that Social Security has never been a complete substitute for comprehensive retirement planning.

My mother taught me long ago, “If you don’t have something nice to say, don’t say anything.” Kind of tough in this situation. How about, “Social Security has been a nice deal for the past 77 years and who knows what the future will bring?”

Advisor Marketing to Shell-shocked, Skeptical Investors

Without faith, people won’t take action. This includes taking risks and making long-term investments.

Without faith, people won’t take action. This includes taking risks and making long-term investments.

Some of my advisor clients moved clients’ money out of the stock market and into variable annuities before the crash of 2008. At least clients who would listen. Others maintained their faith in the stock market and paid the price. Now many investors wonder if they should trust Wall Street at all. So financial advisors need to adjust their messages to overcome this skepticism.

In this article in The Wall Street Journal, Jason Zweig surveys the financial battlefield and offers suggestions to financial advisors on how to regain trust.

Will We Ever Again Trust Wall Street?

For many investors, the market’s turbulence hasn’t just destroyed wealth. It has shattered their faith in the financial system itself.

Consider Philip Eberlin, 56 years old, who runs a woodwork-restoration business in Chicago Heights, Ill. Trading hot stocks a decade ago, Mr. Eberlin got burned on picks like Krispy Kreme and Tyco. In 2007 he got back into stocks, only to take another hit.

“Having been burned twice in 10 years,” says Mr. Eberlin, he now has about 80% of his family’s assets “protected from the market” in certificates of deposit and fixed annuities. “I don’t have trust in Wall Street to help the small investor in any way, shape or form.”

Mr. Eberlin isn’t alone. Late last year, Decision Research of Eugene, Ore., asked Americans how much they trusted bankers and other Wall Street leaders “to reduce the risk of the financial challenges the country is facing now.” On a scale of 1 to 5, with 1 meaning no trust at all, the rating averaged a paltry 1.7.

With such a loss of faith, how will companies be able to obtain the capital they need to expand? The foundations of the financial markets ultimately rest upon the confidence of mom-and-pop investors across the country.

But every investor has a fundamental need to believe that the world is just—that good people are ultimately rewarded, that bad people are eventually punished and that the system isn’t rigged to favor an undeserving few.

This belief in a just world is partly delusional; most of us realize that nice guys often finish last. But this delusion makes short-term setbacks endurable. “A belief that the world is fair and predictable is necessary in order for people to delay gratification and to make investments that will pay off in the long run,” says James Olson, a psychologist at the University of Western Ontario.

So when bad things happen, “people often prefer to blame themselves rather than believe they live in a chaotic and unjust world,” says Dale Miller, a psychology professor at Stanford University.After tech stocks crashed in 2000-2001, for instance, many investors kicked themselves for taking foolish risks.

This time around, however, many investors who followed the best advice were punished the worst. Someone who held a total-stock-market index fund lost more than 58% from October 2007 through March 2009 and remains 31% behind even after last year’s recovery.

These people can’t blame themselves; they did as they had been told. Meanwhile, they watched Wall Street firms parcel out billions in bonuses.

I believe the old truths remain valid: Buying and holding a diversified stock portfolio still makes sense. Paradoxically, as fewer people cling to their faith in traditional stock investing, the future rewards from it are likely to grow greater.

But that can take time. In 1952, two full decades after the Great Crash hit bottom, only 19% of wealthy Americans regarded stocks as the wisest investment choice, according to a Federal Reserve survey. Most investors thus sat out the great bull market of the 1950s, when stocks gained 19.4% annually.

How can faith be restored?

Wall Street firms need to be forthright in admitting their shortcomings. The more they protest their innocence, the more they make the typical investor feel that the financial world is unjust.

The Pecora hearings, held in the U.S. Senate in the 1930s, served partly as a form of public expiation, in which Wall Street’s leaders apologized for their firms’ conduct. The Financial Crisis Inquiry Commission, formed by Congress in 2009 and now holding its own hearings, may help investors feel that Wall Street can own up to its mistakes.

Finally, financial advisers need to be much less dogmatic and confident in their predictions. By admitting the extent of their own ignorance today, they would help prevent investors from feeling railroaded tomorrow.

Retirement Planning and Price Inflation

In a recent post, I warned advisors to be ready with answers to difficult questions. Here’s another one.

“If I follow your investment advice, will my retirement income keep up with inflation?”

In the past year, the Federal Reserve Bank has doubled the money supply. Will this cause higher retail prices? Imagine playing a game of Monopoly and starting the game with $3000 instead of the $1500 called out in the rules since the 1930’s. If you had twice the money, wouldn’t that make it easier to bid on Boardwalk and Park Place? Prices would rise because you’d have more money to spend.

When the Federal Reserve Bank pumps up the money supply, it causes prices to rise and bubbles to form. Bursting bubbles hurt owners of bubble-inflated assets such as tech stocks, mortgage backed securities, and real estate. Rising prices hurts families and especially hurts retirees.

Watch this short video to see how rising prices would affect a 92 year old who retired in 1973 at age 55.

Retirement Planning and the “Trade of the Decade”

Your clients want decent returns and to avoid losses. So where do you put their money? What’s hot one year may be cold as ice the next year. Hence the caveat that “past performance is no guarantee of future results.” Yet when investing for the long-term, it can pay to listen to those who made correct long-term calls in the past. Today’s guest columnist Bill Bonner made a dead-on long-term call 10 years ago…and he just made another for our new decade.

The Last Shall Be First

By Bill Bonner

01/22/10 Paris, France – The yen is falling. It’s down 5% against the dollar since November. Investors are finally noticing. With a deficit of 50% of GDP, the Japanese government walks where angels fear to tread. Americans aren’t far behind. To make a long story short, our money is on the angels.

Only an economist would dare to look 10 years ahead. Only a fool would put money on it. Today, we do both. But our new “Trade of the Decade,” is not so much a look into the future as it is a look at the past.

Ten years ago, your humble correspondent offered his first ‘Trade of the Decade.’ He should have stopped there, for the trade was a big success. It was a simpleton’s trade: Sell US stocks/buy gold. That was in the year 2000. At that time, US stocks had been going up for the previous 18 years, multiplying investors’ money 11 times. By then, stocks had been going up for so long that the memory of man ranneth not to the contrary. Investors’ imaginations saw no alternative. Stocks for the Long Run was the title of a popular book. It was also an investment formula that seemed unbeatable.

Alas, the formula proved beatable. It was time for stocks to go the other way. The first decade of the 21st century proved to be the worst time to hold stocks since the ’30s. Net returns were negative – especially when adjusted for inflation. Adjusted to the CPI, the Dow ended the decade down 40%.

The other side of the trade – the buy side – was just as simpleminded. Gold hit a high over $800 in 1980. Then, it slipped for the next 20 years. It didn’t come to rest until September 1999 at $260. That was the famous “Brown Bottom” in the yellow metal…when the then chancellor of the exchequer, Gordon Brown, sold Britain’s gold at the lowest price in two decades. (To bring readers up to date, now Mr. Brown applies his vision and energy to Britain’s economic recovery efforts.)

Gold is real money. But in the years when gold was being beaten down, other forms of money were running wild. Financial assets mushroomed all over the globe. A whole new ‘shadow banking’ system emerged…with new financial instruments, representing trillions…no, hundreds of trillions…of dollars. Prices on everything were soaring – equity, debt, real property. It did not take a genius to see that gold would have to catch up, sooner or later. As it turned out, no major asset class did better. Gold finished every single year higher than the year before. It doubled. Then, it doubled again.

What made the trade a success was neither clairvoyance nor omniscience; it was merely an observation known as ‘regression to the mean.’ The word ‘normal’ has been in the dictionary for a long time. It must be there for a reason. What it describes is where things tend to go when they’ve gotten out of whack. Regression to the mean is so powerful, no one escapes it. For every decade of walking around time, a person spends a million years dead. Over a century, practically every human regresses to the grave. So, what is so abnormal now that regression to the mean is as certain as death?

Almost all investments are expensive by most historical measures. But if all go down, what will they go down against? Money! That’s why real money – gold – is likely to go up again in the next 10 years. But gold is not cheap. It rose nearly 400% over the last 10 years and now is fairly priced. Gold in the treasure trove found in England last year is worth today about the same thing it was when it was buried 12 centuries ago. It cannot regress to the mean; it is already there.

On the buy side, we are looking for an investment that is despised…not one that is admired. And so, back to Japan, where equities peaked out in 1990 and have been going down ever since. While the Japanese government wanders among the stars, the private sector has dropped back to the ground. Or beneath it. Tokyo-listed stocks have lost 75% of their value, wiping out an entire generation worth of growth. Many Japanese companies sell for less than the value of their current net assets.

And now, after twenty years, Japan’s private businesses are finally benefiting from the stimulus programs. The government will go broke, but by destroying its own credit, Japan cuts the value of the yen and boosts profits for its exporters. Toyota’s local labor costs – in dollar terms – fell 5% in the last three months. And by the time the catastrophe is complete, Japan’s businesses could be the most competitive in the world. One way or another, 10 years from now, we’ll wager that Japanese stocks will be higher…if only relative to the rest of the world’s equities.

But of all the whack that investments might be out of, US Treasury debt stands above them all. For the last 27 years, the US government’s cost of borrowing has gone down. But while bond yields declined, the quantity of US debt exploded. Official, on-the-books debt trebled. Include off the books, unfunded financial obligations and the total reaches $118 trillion – 8 times GDP. And now the explosions come every month. As the depression continues, US deficit-financing needs could rise to $150 billion every 30 days. So far, the bond market has absorbed the shocks with good grace. But sometime in the next 10 years, the angels are bound to be proven right.

Sell US Treasury bonds. Buy Japanese stocks.

Regards,

Bill Bonner,

for The Daily Reckoning

Well, there you have it: Buy Japan and Sell Treasuries. We’ll all see how it all turns out in 2020.

For more insights on investments and the economy with a contrarian and witty twist, click through and subscribe to the Daily Reckoning e-zine.

Source: http://dailyreckoning.com/the-last-shall-be-first-2/

Financial Advisors’ Dilemma: Stay Invested or Go to Cash?

For financial advisors, now is the best of times and the worst of times. Out-of-control government spending, massive deficits, and dicey markets combine to make investing much more challenging for everyone. Including financial advisors. And individual investors who look for professional help. And retirees have seen their nest eggs shrink from ostrich size to turkey size. Or chicken size to sparrow size. With the stock market’s bounce back in 2009, a lot of lost ground has been made up. But will it last? Should investors stay in the market or go to cash?

For financial advisors, now is the best of times and the worst of times. Out-of-control government spending, massive deficits, and dicey markets combine to make investing much more challenging for everyone. Including financial advisors. And individual investors who look for professional help. And retirees have seen their nest eggs shrink from ostrich size to turkey size. Or chicken size to sparrow size. With the stock market’s bounce back in 2009, a lot of lost ground has been made up. But will it last? Should investors stay in the market or go to cash?

This screaming headline from The Telegraph got a lot of attention this week. This well-respected writer’s warning of hyperinflation in Japan has a lot of people thinking, “Could this really happen?” Ambrose Evans-Pritchard recommends staying in cash until the “real” recovery begins in mid to late 2010.

Give this a read and give it some thought. Your next client may walk in the door and ask, “Could this really happen?”

“Global bear rally will deflate as Japan leads world in sovereign bond crisis”

Milton Keynes will be vindicated. Lord Keynes will lose some of his new-found gloss. The Krugman doctrine that we should all spend our way back to health by pushing deficits to the brink of a debt spiral – or beyond the brink – will be seen as dangerous.

By Ambrose Evans-Pritchard, International Business Editor

Published: 6:15AM GMT 04 Jan 2010

The contraction of M3 money in the US and Europe over the last six months will slowly puncture economic recovery as 2010 unfolds, with the time-honoured lag of a year or so. Ben Bernanke will be caught off guard, just as he was in mid-2008 when the Fed drove straight through a red warning light with talk of imminent rate rises – the final error that triggered the implosion of Lehman, AIG, and the Western banking system.

As the great bear rally of 2009 runs into the greater Chinese Wall of excess global capacity, it will become clear that we are in the grip of a 21st Century Depression – more akin to Japan’s Lost Decade than the 1840s or 1930s, but nothing like the normal cycles of the post-War era. The surplus regions (China, Japan, Germania, Gulf) have not increased demand enough to compensate for belt-tightening in the deficit bloc (Anglo-sphere, Club Med, East Europe), and fiscal adrenalin is already fading in Europe. The vast East-West imbalances that caused the credit crisis are no better a year later, and perhaps worse. Household debt as a share of GDP sits near record levels in two-fifths of the world economy. Our long purge has barely begun. That is the elephant in the global tent.

We will be reminded too that the West’s fiscal blitz – while vital to halt a self-feeding crash last year – has merely shifted the debt burden onto sovereign shoulders, where it may do more harm in the end if handled with the sort of insouciance now on display in Britain.

Yields on AAA German, French, US, and Canadian bonds will slither back down for a while in a fresh deflation scare. Exit strategies will go back into the deep freeze. Far from ending QE, the Fed will step up bond purchases. Bernanke will get religion again and ram down 10-year Treasury yields, quietly targeting 2.5pc. The funds will try to play the liquidity game yet again, piling into crude, gold, and Russian equities, but this time returns will be meagre. They will learn to respect secular deflation.

Weak sovereigns will buckle. The shocker will be Japan, our Weimar-in-waiting. This is the year when Tokyo finds it can no longer borrow at 1pc from a captive bond market, and when it must foot the bill for all those fiscal packages that seemed such a good idea at the time. Every auction of JGBs will be a news event as the public debt punches above 225pc of GDP. Finance Minister Hirohisa Fujii will become as familiar as a rock star.

Once the dam breaks, debt service costs will tear the budget to pieces. The Bank of Japan will pull the emergency lever on QE. The country will flip from deflation to incipient hyperinflation. The yen will fall out of bed, outdoing China’s yuan in the beggar-thy-neighbour race to the bottom. By then China too will be in a quandary. Wild credit growth can mask the weakness of its mercantilist export model for a while, but only at the price of an asset bubble. Beijing must hit the brakes this year, or store up serious trouble. It will make as big a hash of this as Western central banks did in 2007-2008.

The European Central Bank will stick to its Wagnerian course, standing aloof as ugly loan books set off wave two of Europe’s banking woes. The Bundesbank will veto proper QE until it is too late, deeming it an implicit German bail-out for Club Med.

More hedge funds will join the EMU divergence play, betting that the North-South split has gone beyond the point of no return for a currency union. This will enrage the Eurogroup. Brussels will dust down its paper exploring the legal basis for capital controls. Italy’s Giulio Tremonti will suggest using EU terror legislation against “speculators”.

Wage cuts will prove a self-defeating policy for Club Med, trapping them in textbook debt-deflation. The victims will start to notice this. Articles will appear in the Greek, Spanish, and Portuguese press airing doubts about EMU. Eurosceptic professors will be ungagged. Heresy will spread into mainstream parties.

Greece’s Prime Minister Papandréou will balk at EMU immolation. The Hellenic Socialists will call Europe’s bluff, extracting loans that gain time but solve nothing. Berlin will climb down and pay, but only once: thereafter, Zum Teufel.

In the end, the Euro’s fate will be decided by strikes, street protest, and car bombs as the primacy of politics returns. I doubt that 2010 will see the denouement, but the mood music will be bad enough to knock the euro off its stilts.

The dollar rally will gather pace. America’s economy – though sick – will shine within the even sicker OECD club. The British will need the shock of a gilts crisis to shatter their complacency. In time, the Dunkirk spirit will rise again. Mervyn King’s pre-emptive QE and timely devaluation will bear fruit this year, sparing us the worst.

By mid to late 2010, we will have lanced the biggest boils of the global system. Only then, amid fear and investor revulsion, will we touch bottom. That will be the buying opportunity of our lives.

Advisor Marketing After the “Year of the Ponzi Scheme”

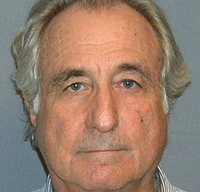

The Wall Street Journal called 2009, “The Year of the Ponzi Scheme.” Many people heard of the term “Ponzi Scheme” for the first time only because of the size of Bernard Madoff’s deal: $50 billion. Sadly with interest rates near zero, many retired people look at high returns delivered by such schemes and get sucked in with their life savings.

The Wall Street Journal called 2009, “The Year of the Ponzi Scheme.” Many people heard of the term “Ponzi Scheme” for the first time only because of the size of Bernard Madoff’s deal: $50 billion. Sadly with interest rates near zero, many retired people look at high returns delivered by such schemes and get sucked in with their life savings.

Someone commented on this with an article about a change in due dilegence. It suggests that financial advisors should investigate the ethics and integrity of the managers of recommended investments. Don’t just look at returns, look at WHO is generating those returns. Can this be done? Should you be held to this standard?

Time will tell if the Ponzi Schemes of 2009 lead to regulatory changes in 2010.

The Year of the Ponzi Scheme

If you weren’t familiar with the name “Ponzi” last year, you sure learned it quickly this year, along with the names “Madoff,” “Dreier,” “Petters,” and all the others who followed in the footsteps of the notorious fraudster Charles Ponzi.

That’s because, as the Associated Press reports, the number of Ponzi schemes that came to light in the U.S. has nearly quadrupled in the last year. The schemes, in which perpetrators lure investors with promises of high returns and use new investors’ cash to pay the old ones (and, of course, grab cash for themselves), topped 150 this year, compared to about 40 last year.

As a result, the AP says “tens of thousands of investors” lost more than $16.5 billion this year. That figure doesn’t include the $19.4 billion that Bernard Madoff is estimated to have bilked his investors out of in the largest Ponzi scheme ever, because Madoff was arrested in December 2008.

The AP’s review of federal and state criminal cases found that amid the recession and heightened public awareness of Ponzi schemes, the federal government stepped up its pursuit of suspected fraudsters. The Federal Bureau of Investigation launched more than 2,100 probes into securities fraud, up from last year’s 1,750 investigations, and it increased by one-third the number of agents working on high-yield investment fraud cases. And the Securities and Exchange Commission issued 82% more restraining orders and devoted more of its workload to investigating potential scams.

Source: http://blogs.wsj.com/bankruptcy/2009/12/29/the-year-of-the-ponzi-scheme/

NATIONAL BUSINESS MEDIA NOT COVERING TRUE REASONS FOR INVESTOR FRAUD SCANDALS

Dale Yeager a nationally known criminal analyst says that news coverage of the recent investor scandals is missing a critical aspect of these crimes. This overlooked issue is something Yeager calls the “Due Diligence Mess.”

Yeager, says the problem is the antiquated way due diligence is performed for investors.

“The financial crimes of the past year will continue to occur unless radical changes are made in the due diligence process,” states Yeager. “Due diligence must be performed as a criminal investigation not just a financial assessment.”

Based on his experience performing over 200 financial investigations, he believes that the focus must be on the ethics of the people operating the organization the investor will be placing their money into.

“Due diligence is about assessing a person’s credibility” states Yeager, “and people assessment has and always will be the domain of forensic psychology. Look at the amount of negative information that reporters have discovered about Madoff over the past few months. Information that provides a specific psychological profile of him, showing a lifelong pattern of narcissistic and unethical behavior.”

Yeager lays out a plan of action to prevent investor fraud with his article, “The Due Diligence Mess: 3 Reasons Why Ponzi Schemes and Investor Fraud Will Continue”.

“People have become accustom to using forensic accountants,” states Yeager. “But they need to become accustom to using that process in accessing behavior and personal ethics.

Learning From Harvard’s Investment Mistakes

Article: Harvard Swaps Are So Toxic Even Summers Won’t Explain

Financial advisors can learn a lot about what “not to do” by studying this article on Bloomberg today.

Financial advisors can learn a lot about what “not to do” by studying this article on Bloomberg today.

I’ll summarize what happened and then provide some commentary along with some choice quotes.

- Harvard planned a major campus expansion and wanted to lock in low interest rates 4 years before they needed the money

- Harvard invested in “forward swaps” to lock in “low interest rates” for the project’s financing.

- These investments bets assumed that interest rates would rise from the existing 2.25% level.

- The Federal Reserve Bank subsequently cut short term rates to .26%.

- The value of the swaps went to a negative $460MM by June 2005 as rates rose. Lesson: Understand your downside risk.

- During the meltdown in 2008, Harvard “cuts its losses” on its swap investments by paying over $1 billion to various banks including JPMorgan, Goldman Sachs, Morgan Stanley, and Bank of America. $500 million up front and the rest paid over 40 years.

- “December 2008 was, by an enormous amount, the worst time in history” to terminate the swaps by borrowing money, said Peter Shapiro, a swap adviser at Swap Financial Group.

- This turned out to be the bottom of the market. Oops. “Concerned that its losses might worsen, the school borrowed money to terminate the swaps at the nadir of their value, only to see the market for such agreements begin to recover weeks later.”

Apparently none of these investment notables had read about Ray Lucia’s “Buckets of Money” strategy:

Making matters worse, Harvard disclosed Oct. 16 that its checkbook fund, the general operating account, lost $1.8 billion in the year ended June 30. Lumping the cash account with the endowment was risky, said Louis Morrell, who managed the endowment for Radcliffe College, which is part of Harvard, until 1990.

“They put the operating funds in the endowment –it’s like the guy who has his retirement income in company stock,” said Morrell, who is also the former treasurer of Wake Forest University in Winston-Salem, North Carolina.

This last move meant that Harvard’s operating account fell by $1.8 billion in just one year. So they had to scramble to raise cash.

As vanishing credit spurred the government-led rescue of dozens of financial institutions, Harvard was so strapped for cash that it asked Massachusetts for fast-track approval to borrow $2.5 billion. Almost $500 million was used within days to exit agreements known as interest-rate swaps that Harvard had entered to finance expansion in Allston, across the Charles River from its main campus in Cambridge, Massachusetts.

Lesson here would be don’t invest cash needed for day-to-day expenses.

Harvard Corp. had a 7-member ruling body approve the transactions. This committee included some well-known figures:

- Lawrence Summers, former Secretary for President Clinton, then Harvard President, now serves as President Obama’s Economic Advisor

- James Rothenberg, his Los Angeles-based company, Capital Group, operates American Funds

- Robert Rubin, former U.S. Treasury Secretary and Summers’s previous boss and predecessor at the U.S. Treasury

- Robert D. Reischauer, former director of the Congressional Budget Office.

Lesson here is don’t be swayed by celebrity endorsements.

Other smaller colleges seem to be learning from Harvard’s mistakes:

Harvard’s woes stemmed from misunderstanding its role, said Leon Botstein, president of Bard College in Annandale-on-Hudson, New York.

“We shouldn’t be in the banking business, we should be in the education business,” Botstein said in a telephone interview.

Another lesson is don’t depend on regulators to protect investors:

Summers, along with Rubin and Greenspan opposed the U.S. Commodity Futures Trading Commission’s attempt in 1998 to regulate so-called over-the- counter derivatives, which included agreements like interest rate swaps. At the time, Summers was Rubin’s deputy secretary.

Now Summers is leading the Obama administration’s effort to write stricter rules for the derivatives market “to protect the American people,” he said in October at a conference in New York sponsored by The Economist magazine.

Better late than never I guess.

The article pointed out Summers was forced to resign as Harvard’s president “after he questioned women’s innate aptitude for math and science.” I bet few American housewives would look to forward swaps when the family plans to build a larger home in 4 years.

In fact, I bet most American housewives would question the wisdom of Harvard borrowing money to build buildings when it had $22.6 billion in its endowment. Some 4-year colleges, like Grove City College, don’t build any buildings until they’ve raised the necessary funds and have the money in the bank. Being debt free, Grove City College has tuition less than half of Harvard University. There’s gotta be a lesson in there someplace.

A final lesson: People shouldn’t invest on the basis of what rich and famous people are doing:

“You can be very big and very rich and very smart and still get things wrong,” Shapiro said.

Source: http://www.bloomberg.com/apps/news?pid=20601087&sid=aHQ2Xh55jI.Q