Advisor Marketing Giving Away Great Information

Richard Emmons explains how financial advisors can improve their marketing by giving away high quality and free information.

httpv://www.youtube.com/watch?v=54r49YIOm_k

Marketing Lessons from Warren Buffett

Warren Buffet released Berkshire Hathaway’s annual shareholder letter on Saturday. Let’s look at this letter and draw some marketing lessons for financial advisors.

Warren Buffet released Berkshire Hathaway’s annual shareholder letter on Saturday. Let’s look at this letter and draw some marketing lessons for financial advisors.

Create an Event. Warren Buffett receives tons of free publicity before, during, and after his eagerly anticipated letter to shareholders is released each year.

What can a financial advisor do? Every April 15th, taxpayers line up at the post office to file their income taxes. You can provide them with hot coffee and cookies. Be sure to tip off your local newspaper about this special “tax relief” effort. Or perhaps there’s an annual charity auction in your town. Donate a free pair of hearing aids and say that “My clients say I’m a good listener and appreciate hearing my financial advice. Let me help someone become a better listener this year.”

Do your event every year and you’ll get lots of publicity from it.

Be Consistent. Warren Buffett writes this shareholder letter every year. Not just in the good years. And he always presents an image of consistent, Midwestern, and reliable investing. You can’t change your branding message and targeted clientele very often or you’ll appear to be appeal to everyone and noone at the same time. Here’s how a blogger for the Wall Street Journal describes this,

Every few years, critics say Warren Buffett has lost his touch. He’s too old and too old-fashioned, they claim. He doesn’t get it anymore. This time he’s wrong.

It happened during the dotcom bubble, when Mr. Buffett was mocked for refusing to join the party. And it happened again last year. As the Dow tumbled below 7,000, Mr. Buffett came under fire for having jumped into the crisis too early and too boldly, making big bets on Goldman Sachs and General Electric during the fall of 2008, and urging the public to plunge into shares.

Now it’s time for those critics to sit down for their traditional three course meal: humble pie, their own words and crow. Source: http://online.wsj.com/article/SB10001424052748704089904575093603081648166.html?mod=WSJ_hp_editorsPicks

Keep Your Brand Fresh. Being consistent in your marketing doesn’t mean never change anything. In today’s Heard on the Street column in the Wall Street Journal, Liam Denning writes that

Warren Buffett’s latest shareholder letter can be summed up thusly: This isn’t your father’s Berkshire Hathaway.

The chairman’s letter was billed, in part, as a “freshman orientation session” for Burlington Northern Santa Fe shareholders receiving Berkshire stock in connection with November’s acquisition. Those investors thinking of buying a slice of Mr. Buffett’s genius now that Berkshire’s “B” shares reside in Standard & Poor’s 500-stock index should join the class.

Mr. Buffett says he has lost his earlier distaste for capital-intensive businesses. Like other mature, successful businesses, Berkshire generates so much cash that deploying it all in high-growth investment opportunities is a stretch even for Mr. Buffett.

…Large, utility-like businesses offer what Mr. Buffett calls “decent” returns on a bigger slug of capital than higher-risk, potentially spectacular returns on smaller investments.

Jeff Matthews, author of “Pilgrimage to Warren Buffett’s Omaha,” reckons Berkshire is becoming more of a “widows and orphans” stock, with the investment case resting less on the alchemy of Mr. Buffett’s stock picking. Less exciting, perhaps, but necessary if Berkshire is to carry on after America’s most famous investor hangs up his spurs. Source: http://online.wsj.com/article/SB10001424052748703431604575095743489061252.html?mod=WSJ_Markets_section_Heard#articleTabs%3Darticle

Make it easier for people to do business with you. One of the reasons the shareholder’s letter was a “freshman’s orientation session” was because they added over 100,000 new shareholders during the year.

If you bought an advisor’s book of business you would want to communicate the basics of doing business with you: communication channels. annual reviews, etc. If you added 10 new clients per living trust seminar, you’d have over 100 new clients at the end of the year. Never assume they know the in’s and out’s of doing business with you or how you invest or how you do financial planning.

Berthshire also did a 50 to 1 stock split to lower the share price of the B shares. A lower price means more people can buy a hundred shares. Plus they’ll be added to the S&P 500 in a few months which means people will buy them when they buy the S&P 500 index.

Perhaps you only accept new clients with a minimum of $500,000 of investable assets. You could add a junior planner and lower your minimum to $250,000. This effectively lowers your “price” and makes it easier for more people to do business with you.

Advisor Marketing Success with a “Sales Lead Machine”

If you’re a financial advisor getting ready to retire, this post is definitely not for you. Or if you have so many long-time and new clients you can’t imagine squeezing one more client into your crowded schedule, then please ignore this message. Now let me talk to the rest of you out there!

If you’re a financial advisor getting ready to retire, this post is definitely not for you. Or if you have so many long-time and new clients you can’t imagine squeezing one more client into your crowded schedule, then please ignore this message. Now let me talk to the rest of you out there!

There are lots ways to get more sales leads:

- Yellow page ad

- Radio show

- Walk-in traffic

- Asking clients for referrals

Yet these sources are unpredictable and not really repeatable. Sometimes you get leads when you’re crazy busy. And other times your appointment schedule is getting light and the telephone just won’t ring.

What you need to develop is a “sales lead machine.” You want to create a marketing program which generates a consistent and ongoing stream of prospective clients.

You need to find what works well and what works for you. This can take some testing. Or you can take an existing marketing system and adapt it to your particular practice. Let me give you a few ways I’ve helped clients create a lead machine.

One way is to create a free report and offer it in your advertising. The report can be in the form of a written report such as the “7 Most Common Retirement Planning Mistakes…and How To Avoid Them.” Better yet, you can create an “expert audio CD” which your prospects can listen to in their car. The trick is to offer a physical report so interested parties need to give you call you and provide their mailing address. Get their phone number and email to follow-up to find out if they have any questions about the report. Your report should generate questions in their minds as well as establish you as the expert to provide the answers. When you want to turn on your lead machine, just mail some postcards or run a display ad in your newspaper or a weekly paper directed at senior citizens. You’ll be able to test your ad based on the number of people who call and ask for the report.

My favorite “sales lead machine” is to help advisors put on living trust seminars. Yes, getting your first seminar involves a lot of work including getting your newspaper ads designed and past compliance, choosing a restaurant, and establishing a relationship with an estate planning attorney. Yet the key advantage of buying a sales lead machine is that you avoid all the trial and error of designing ads and creating the tools to make it a system. Yesterday, one advisor held his first 2 seminars and had 14 attendees in the mid-day seminar and another 16 in the evening. Future seminars build on prior seminars because the ads establish the advisor as an estate planning expert. Plus his presentation skills will improve as he commits the presentation to memory and weaves in more of his own war stories.

Let’s break down his sales lead machine and see how it turns leads into clients:

- Schedule the seminar and confirm the date with the estate planning attorney

- Book the facility and update the newspaper advertisement

- Notify your mailing list of the upcoming seminar and run your newspaper ads

- Hold the seminar and establish yourself as an estate planning expert by educating the attendees.

- Schedule attendees for initial consultations and assist the attorney through the trust process

- Assist trust clients through estate planning and gently turn them into financial planning clients….

Now this advisor has scheduled seminars monthly so he’ll generate a steady stream of new clients during the year. Advisor/CPA’s who focus on taxes during the tax season would schedule seminars after April 15th.

Other clients hold elaborate client appreciation dinners in December. Clients get wined and dined and educated by a noted speaker. Of course, they are encouraged to invite a neighboring couple. Get this formula down and you’ll have a very busy January and February!

“Random acts of kindness” might make this world a better place. However, “random acts of marketing” usually waste money and don’t generate consistent leads. For that you need a sales lead machine.

Advisor Marketing with Better Business Cards

You want to be remembered and you want to provide a reason for someone to keep your business card. Watch this short video to learn how to improve the effectiveness of your business cards without spending any more money.

httpv://www.youtube.com/watch?v=WQfi7tiGzOQ

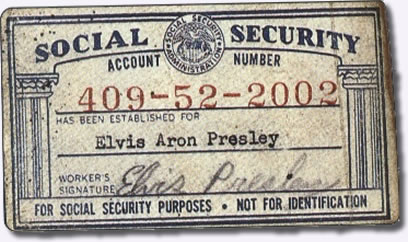

Advisor Marketing on the Latest Social Security Bailout

Social Security is back in the news these days. And the news isn’t pretty. We’ve seen a steep and prolonged drop in employment during this recession. Now social security tax revenues have now fallen below the benefits being paid out to current retirees. This hasn’t happened in 25 years so Congress needs to “do something” and you may get asked your opinion on this. Maybe in your office and maybe on your live radio show.

Social Security is back in the news these days. And the news isn’t pretty. We’ve seen a steep and prolonged drop in employment during this recession. Now social security tax revenues have now fallen below the benefits being paid out to current retirees. This hasn’t happened in 25 years so Congress needs to “do something” and you may get asked your opinion on this. Maybe in your office and maybe on your live radio show.

Financial advisors need to walk a fine line here. You have clients born before 1946 when the baby boomers first came on the scene. You have baby boomer clients who have retired after paying into Social Security their entire working careers. Other Baby Boomers have paid into Social Security for decades who won’t receive full benefits until age 67. You may have a growing number of Gen X/Y clients who will pay the most into Social Security and get the fewest benefits.

A couple recent articles underscored the coming generational battle over funding Social Security and who gets what benefits. One article on CNBC.com placed the blame squarely on the shoulders of the Baby Boomers:

Will Baby Boomers Bankrupt Social Security?

As the record federal budget deficit draws increasing scrutiny from Washington to Wall Street to Main Street, deficit hawks may take aim at entitlement programs including Social Security.

And, the nearly 80 million Baby Boomers phasing into retirement will set in motion a dynamic that—if not addressed by Congress—could result in the next generation getting fewer benefits.

After some soothing words about the strength of the ‘trust fund”, the article describes the affect of the Baby Boom generation:

Looking back, the outlook was rosy for most Americans in 1946, the year earmarked as the beginning of the so-called “baby boom.” With World War II finally over, a 15-year stretch of bad times that had begun with the great Depression was finally over. They responded by having more babies than ever before, more than 78 million of them by 1964.

For Social Security, the mini-population explosion was both beneficial and problematic. Social Security is funded mostly through payroll taxes, with present-day workers funding the payouts for retirees. Since there have been so many Boomers in the workforce for so many years, there were a lot more people putting money into the system than taking it out.

As Boomers begin to retire, the huge group of people putting money into the system will begin taking it out of the system, which then will be funded by a generation of workers—the so-called Gen X—whose numbers are some 15 million fewer. The surplus of money paid into the system by Boomers will allow it to run into the late 2030s, even though it will begin paying out more than it takes in by 2017.

Before I show how the 2017 forecast won’t happen, let’s listen to a Gen X’r to get a taste of the coming divide:

Count Gen-Xer Tom Firey among those younger workers who think they’re getting the short end of the stick. The managing editor of the conservative Cato Institute magazine, Regulation, first wrote about the subject nearly 10 years ago in a column headlined, “Boomers Fleece Generation X with Social Security.”

“Ever since we Gen-X/Yers began working, we’ve paid 12.4 percent of our earnings to Social Security,” he wrote. “In contrast, the Boomers will get a bargain. When they entered the workforce in the late 1960s, they paid only 6.5 percent of their earnings to Social Security. Only from 1990 on, when the Boomers had earned paychecks for a quarter-century, did they start paying 12.4 percent to Social Security, the same percentage we Gen-X/Yers have paid our whole lives.”

That’s why Firey dubbed it The Boomers’ Bargain: “They’ve paid less of their earnings into Social Security than we Gen-X/Yers, yet they’ll receive more in benefits than we will and we’ll pick up the tab.”

As often comes with age, Firey has mellowed some in the past 10 years, even injecting dark humor into his outlook today. He says, “The last two generations gave themselves some additional retirement benefits just before they left the workforce. The World War II generation gave itself annual COLA (cost-of-living allowance) raises in 1975, and the boomers gave themselves the prescription drug benefit earlier this decade.”

“In essence, these generations said, ‘I’m not willing to pay for these new benefits for myself, but I’m happy to force my kids and grandkids to pay for these benefits for me,’ “Firey added.

You can read the rest to learn about the Greenspan Commission of 1983. http://www.cnbc.com/id/34941334 Like President Carter’s fix in the late ’70’s, the Greenspan Commission’s recommendations of benefit cuts and tax hikes spared current retirees and supposedly fixed the problem for “30 years.”

You might be telling yourself, “What about the Trust Funds? Richard forgot about the trust funds!” My short answer is, “What trust? What funds? And what security?”

The reality of the situation is that the trust funds and $3 will buy you a cup of coffee at Starbucks. Now let’s look at the math and why Social Security needs a bailout.

Next in line for a bailout: Social Security

By Allan Sloan, senior editor at large, Fortune magazine

February 2, 2010

NEW YORK (Fortune) — Don’t look now. But even as the bank bailout is winding down, another huge bailout is starting, this time for the Social Security system.

A report from the Congressional Budget Office shows that for the first time in 25 years, Social Security is taking in less in taxes than it is spending on benefits.

Instead of helping to finance the rest of the government, as it has done for decades, our nation’s biggest social program needs help from the Treasury to keep benefit checks from bouncing — in other words, a taxpayer bailout.

No one has officially announced that Social Security will be cash-negative this year. But you can figure it out for yourself, as I did, by comparing two numbers in the recent federal budget update that the nonpartisan CBO issued last week.

The first number is $120 billion, the interest that Social Security will earn on its trust fund in fiscal 2010 (see page 74 of the CBO report). The second is $92 billion, the overall Social Security surplus for fiscal 2010 (see page 116).

This means that without the interest income, Social Security will be $28 billion in the hole this fiscal year, which ends Sept. 30.

Why disregard the interest? Because as people like me have said repeatedly over the years, the interest, which consists of Treasury IOUs that the Social Security trust fund gets on its holdings of government securities, doesn’t provide Social Security with any cash that it can use to pay its bills. The interest is merely an accounting entry with no economic significance.

The last sentence might have grabbed your attention. Surprised me to see it in a mainstream publication like Fortune magazine. Maybe it shouldn’t surprise us. How do you pay your business expenses, with cash or with accounts receivables? Of course, you can’t pay bills with IOU’s unless you first convert the IOU’s into cash. Same problem for the federal government except that Uncle Sam is already borrowing over a trillion dollars this year.

You can read the rest of the Fortune article here: http://money.cnn.com/2010/02/02/news/economy/social_security_bailout.fortune/index.htm

So how do you apply your marketing mindset to handle this situation? In your office, you deal with each person or couple based on their situation. Social Security is just one more (obviously major) factor to consider.

- All of your clients who are still in the work force should be reminded that Social Security was never intended to be the mainstay of a person’s retirement income. So they should be encouraged to work longer and save more and not retire until they have enough money invested to outlast their expected lifetimes.

- Gen X’rs can get your sympathy: A worker earning $95,000 per year who expects to retire in 2045 will pay in $200,000 more in Social Security taxes than he or she will receive in benefits. Ouch.

- For your retired clients, you can use annual reviews to compare their retirement nest egg against their life expectancy. Maybe they should go back to work. Or cut their expenses. Or sell their home, downsize and invest the difference.

What if you’re asked this question on your radio show? Well, you need to be careful so you don’t needlessly inflame your listeners. Here are some possibilities:

- You can blame Congress for spending the Social Security trust funds.

- You can blame Congress for not acting sooner (and reminding your listeners that Congress still needs to act on the federal estate tax situation).

- You can say that everyone’s situation is different so you can’t offer financial advice without more information (kinda wimpy but might result in a visit to your office)

- You can offer general advice that Social Security has never been a complete substitute for comprehensive retirement planning.

My mother taught me long ago, “If you don’t have something nice to say, don’t say anything.” Kind of tough in this situation. How about, “Social Security has been a nice deal for the past 77 years and who knows what the future will bring?”

Advisor Marketing to Shell-shocked, Skeptical Investors

Without faith, people won’t take action. This includes taking risks and making long-term investments.

Without faith, people won’t take action. This includes taking risks and making long-term investments.

Some of my advisor clients moved clients’ money out of the stock market and into variable annuities before the crash of 2008. At least clients who would listen. Others maintained their faith in the stock market and paid the price. Now many investors wonder if they should trust Wall Street at all. So financial advisors need to adjust their messages to overcome this skepticism.

In this article in The Wall Street Journal, Jason Zweig surveys the financial battlefield and offers suggestions to financial advisors on how to regain trust.

Will We Ever Again Trust Wall Street?

For many investors, the market’s turbulence hasn’t just destroyed wealth. It has shattered their faith in the financial system itself.

Consider Philip Eberlin, 56 years old, who runs a woodwork-restoration business in Chicago Heights, Ill. Trading hot stocks a decade ago, Mr. Eberlin got burned on picks like Krispy Kreme and Tyco. In 2007 he got back into stocks, only to take another hit.

“Having been burned twice in 10 years,” says Mr. Eberlin, he now has about 80% of his family’s assets “protected from the market” in certificates of deposit and fixed annuities. “I don’t have trust in Wall Street to help the small investor in any way, shape or form.”

Mr. Eberlin isn’t alone. Late last year, Decision Research of Eugene, Ore., asked Americans how much they trusted bankers and other Wall Street leaders “to reduce the risk of the financial challenges the country is facing now.” On a scale of 1 to 5, with 1 meaning no trust at all, the rating averaged a paltry 1.7.

With such a loss of faith, how will companies be able to obtain the capital they need to expand? The foundations of the financial markets ultimately rest upon the confidence of mom-and-pop investors across the country.

But every investor has a fundamental need to believe that the world is just—that good people are ultimately rewarded, that bad people are eventually punished and that the system isn’t rigged to favor an undeserving few.

This belief in a just world is partly delusional; most of us realize that nice guys often finish last. But this delusion makes short-term setbacks endurable. “A belief that the world is fair and predictable is necessary in order for people to delay gratification and to make investments that will pay off in the long run,” says James Olson, a psychologist at the University of Western Ontario.

So when bad things happen, “people often prefer to blame themselves rather than believe they live in a chaotic and unjust world,” says Dale Miller, a psychology professor at Stanford University.After tech stocks crashed in 2000-2001, for instance, many investors kicked themselves for taking foolish risks.

This time around, however, many investors who followed the best advice were punished the worst. Someone who held a total-stock-market index fund lost more than 58% from October 2007 through March 2009 and remains 31% behind even after last year’s recovery.

These people can’t blame themselves; they did as they had been told. Meanwhile, they watched Wall Street firms parcel out billions in bonuses.

I believe the old truths remain valid: Buying and holding a diversified stock portfolio still makes sense. Paradoxically, as fewer people cling to their faith in traditional stock investing, the future rewards from it are likely to grow greater.

But that can take time. In 1952, two full decades after the Great Crash hit bottom, only 19% of wealthy Americans regarded stocks as the wisest investment choice, according to a Federal Reserve survey. Most investors thus sat out the great bull market of the 1950s, when stocks gained 19.4% annually.

How can faith be restored?

Wall Street firms need to be forthright in admitting their shortcomings. The more they protest their innocence, the more they make the typical investor feel that the financial world is unjust.

The Pecora hearings, held in the U.S. Senate in the 1930s, served partly as a form of public expiation, in which Wall Street’s leaders apologized for their firms’ conduct. The Financial Crisis Inquiry Commission, formed by Congress in 2009 and now holding its own hearings, may help investors feel that Wall Street can own up to its mistakes.

Finally, financial advisers need to be much less dogmatic and confident in their predictions. By admitting the extent of their own ignorance today, they would help prevent investors from feeling railroaded tomorrow.

Advisor Marketing with Client Newsletters

The great thing about email these days is that it’s fast, easy and free. Yet take a look at your own in-box. Do you see lots of non-urgent messages you want to read when you get more time. Will you end up reading them? Or will you just delete them before you leave on your next vacation?

In this day of email overload, a printed client newsletter can help you stand out from your competitors and get noticed by your clients and prospects.

Watch this short video and learn the advantages of sending using a snail mail newsletter to stay in touch with your clients and prospects.

httpv://www.youtube.com/watch?v=a_HoZ3_7aok

Advisor Marketing Success By Focusing On “You” Not “I”

Whenever I need to improve a sales letter, yellow page ad, magazine ad, or web page, I first zero in on something simple. Does the ad speak about the advisor or firm? Or does it speak about what’s in it for the client? What’s the ratio of “I” or “mine” versus “You” or “yours”?

Let me ask you a question: Do you read this website to learn about me or learn how to grow your financial planning practice with better marketing?

My mom might read this site to learn something new about me. Maybe. The rest of you read this because you want more clients, you want more assets under management, and you want to reduce the hassles of running a financial planning practice so you can enjoy your life more?

Seems so simple but 99% of ads out there don’t get this.

I first learned this concept from Jay Abraham in 1989. He taught me everyone is tuned into the same radio station: WII-FM. Remember WII-FM in your marketing and you’ll find success.

What does WII-FM stand for? “What’s In It For Me?”

That’s what you care about when you read these articles or get my living trust seminar product or hire me to redesign your website.

Your clients, and especially your prospecs, don’t care about your problems. They really only care about their problems:

- Their retirement income…”Will I have enough?”

- Their financial goals…”When can I retire?”

- Their children’s college fund… “How can pay for college for all my kids?”

- Their long-term-care risk… “What if my husband gets Alzheimers?”

Let me show you a political example of when this I/You concept is lost. It features President Obama. His campaign for president was a marketing tour-de-force. Master Clayton Makepeace called his budget proposal “The best sales copy ever on the worst product ever.” So he has staff who know their marketing. It seems that they took the day off a few days ago when the President gave this speech. Here is a 2 minute clip to make my point:

http://www.youtube.com/watch?v=I9UIpW_3P5s

You need to avoid the “I/my” approach in your marketing or your prospects will avoid you.

Advisor Marketing: Taking Public Positions on Tax Increases

In this short video, Richard takes you into the “voting booth” and votes against 2 tax increases on the ballot in Oregon. What does this have to do with advisor marketing success?

Remember in most elections candidates and ballot measures win 51% to 49%. So whenever you take a public stand on a political matter you’ll likely to get half the voters mad. Your marketing mindset should tell you not to get your clients and prospective clients hopping mad with something you say!

Advisor Marketing with Ready Answers for Difficult Questions

As a financial advisor you’re used to asking your clients hard questions.

As a financial advisor you’re used to asking your clients hard questions.

- What’s your tolerance for risk?

- Are you okay with short-term losses to make long-term gains?

- Who gets your money when you die?

Sometimes clients have ready answers. Other times a couple will look at each other and tell you, “We need to talk about this.” No problem, you don’t expect a ready answers for these tough questions.

But what about when your client or a prospective client asks YOU some tough questions? Are you ready with good answers?

In a recent issue, Fortune magazine named Apple CEO Steve Jobs, the “CEO of the Decade.” Steve Jobs is a master showman and watching his product intros is always a kick…even if you’re a hardcore Windows/Blackberry guy. This quote really jumped out at me:

A key Jobs business tool is his mastery of the message. He rehearses over and over every line he and others utter in public about Apple. ~ Fortune

For the curious, you can watch him in action below when he introduced the Macintosh (1984), iPod (2001) and iPhone (2007). He only had one chance to make a good first impression. So Steve practiced his lines over and over again and nailed the presentation.

Fortunately, you’ll likely be alone with your client in your office or conference room. A larger venue might be a living trust seminar with 25 or 30 people in the room. While a smaller stage than Steve Jobs commands, your ability to provide a sincere and convincing answer can win or lose the account.

What might you get asked? I dug around the Internet and found numerous lists of “questions to ask your financial advisor.” Here are some highlights:

5 Questions To Ask a Potential Financial Advisor

1. Tell Me About Your Ideal Client

Any good financial advisor will have an area of expertise. You want someone who has expertise working with someone like you. If you’re about to retire, and they tell you they work with young families, maybe this isn’t the person for you. Find a financial advisor whose ideal client sounds very similar to your situation in terms of age, stage of life, and asset level.

3. Ask A Potential Financial Advisor to Explain A Concept To You

What you are looking for here is, can you understand their explanation? If they speak over your head, or their answer makes no sense, then move on. You want to work with someone who can explain financial concepts to you in language you can understand.

Below are five concept oriented questions to consider asking:

- What is passive vs. active investing?

- How do you determine how much of my money should be in stocks vs. bonds?

- What is a laddered bond portfolio?

- How do you determine how much money I can safely withdraw each year without running out?

- What do you think of annuities?

Seven Questions to Ask When Picking a Financial Adviser (The Wall Street Journal)

As investors look for guidance in these troubled markets, one question looms above all others:

Whom can you trust?

During boom times, it was easy to hire a financial adviser and put your money on autopilot. Now the market is in chaos and thousands of investors have been devastated by fraud, with Madoffed threatening to become an all-too-common verb.

Small wonder that many investors are getting reluctant to put their faith in experts. More than three-quarters of individuals with at least $1 million to invest intend to move money away from their financial advisers, and more than half intend to leave their advisers altogether, according to Prince & Associates Inc., a market-research firm.

The trouble is, many investors don’t have the time or expertise to make all of their own investment decisions. So, having a professional on your side is crucial. But how can you guarantee that your expert is reliable?

6. Can the adviser put it in writing?

Ask for a formal written outline of the services the adviser will be providing and what fees you will be paying. By setting concrete expectations, you can determine if an adviser is going to, say, “help you set goals and do budgeting or just make investment decisions,” says Ellen Turf, chief executive of the National Association of Personal Financial Advisors.

For instance, you can ask advisers to spell out what they think you are trying to achieve and what they think you should do to get there, including investment strategies, specific benchmarks and suggested financial products. If advisers can’t explain their plan in simple terms, another red flag should go up. Secret strategies like those touted by Mr. Madoff are no longer acceptable, Mr. Sonnenfeldt says.

Also ask advisers to spell out who else stands to gain from your relationship — such as affiliated broker-dealers and insurance agencies — as well as exactly how much the adviser, the adviser’s firm and all those other parties will earn from your business.

Finally, find out whether the advisers are going to take on fiduciary responsibility, in which they are legally bound to act in your best interest. If advisers don’t take this oath, they’re only required to sell you products that are deemed suitable for you — and those may not always be the best fit for your financial situation or objectives.

Eight Questions to Ask Your Financial Advisor

(1) Do you use a comprehensive approach to financial planning by directing our efforts around a written plan based upon my specific goals?

(2) How will you communicate, both initially and through time, what I am paying you, how I am paying you, and what I am receiving for it?

(3) Do you have any conflicts, limitations, or encumbrances that I need to be aware of, and will you communicate them in the future if any arise?

(4) What is your core philosophy regarding your work? What results would lead YOU to conclude that our work together is successful?

(5) Are you acting as a specialist or a generalist? In either case, who will be coordinating the specialists that will be needed over time to address my changing needs?

(6) How often do you meet with clients? What do those meetings look like, and what communication methods do you use between meetings?

(7) Will I be working directly with you, or through skilled assistants, and what procedures should I expect as far as phone calls made and received, mail sent and received, etc.?

(8) What issues, topics, or challenges should I NOT be concerned about, despite what I may hear through the media; what issues, topics, or challenges SHOULD I be concerned about, despite not hearing much about it; and, how will you help me do that?

How to Choose a Planner (CFP Board)

2 Q. What are your qualifications?

A. The term “financial planner” is used by many financial professionals. Ask the planner what qualifies him to offer financial planning advice and whether he is recognized as a CERTIFIED FINANCIAL PLANNER™ professional or CFP® practitioner, a Certified Public Accountant-Personal Financial Specialist (CPA-PFS), or a Chartered Financial Consultant (ChFC). Look for a planner who has proven experience in financial planning topics such as insurance, tax planning, investments, estate planning or retirement planning. Determine what steps the planner takes to stay current with changes and developments in the financial planning field. If the planner holds a financial planning designation or certification, check on his background with CFP Board or other relevant professional organizations. [Nice to see they included ChFC along with CFP.]

15 Questions to Ask a Financial Advisor [written by a CPA who is also a financial advisor]

3. Can the advisor explain their investment philosophy in simple language? A 10-year-old should be able to understand the logic of the investment philosophy.

5. Ask the advisor, “why are you in the business?” “Besides your alarm clock, what makes you get up in the morning?”

6. Can evidence be presented to back up the advisor’s investment approach?

7. Where is the advisors own money invested?

That last question might stump many advisors. Would you use a realtor to buy a house who has rented his whole life? Or buy stocks through a stockbroker who keeps all his money in money market funds? Would you keep your savings with a banker who keeps his savings under his mattress? Probably not.

So my advice to you is to click through a few of these articles and try to see things from your client’s perspective. You want to develop clear, convincing and sincere answers to these types of questions. Practice in front of a mirror. Ask your spouse to role play. Or use your webcam to record your answers and give them a critical view. You’ll be glad you did.

Now watch what careful preparation did for Steve Jobs. He made a great first impression. And followed through later on what he said. And prospered. Go and do likewise!

http://www.youtube.com/watch?v=G0FtgZNOD44

http://www.youtube.com/watch?v=gQ2CMMdowu0&feature=related